MA ECONOMICS

NOTES AVAILABLE IN REASONABLE PRICE

Macroeconomics and Microeconomics: Chit Chat

CHIT-CHAT TIME Commerce Heaven (In this conversation after getting 1000 Rupees Khalid is going with his friend Tariq to purcha...

Monday, January 30, 2012

Monday, January 23, 2012

Classical Economics

ECONOMICS

KHALID AZIZ

0322-3385752

Classical Economics

The Quantity Theory of Money The Quantity Theory of Money seeks to establish that, in the long run, the price level/ rate of inflation is determined by the level/ rate of increase of the money supply. Although the Quantity Theory of Money is an extremely old proposition, it was first formalised in the early part of the 20th century by Yale economist, Irving Fisher and later by a group of Cambridge economists, Alfred Marshall and most notably A. C. Pigou. (a) Fisher’s Transactions Approach This approach first emerged in Fisher’s book The Purchasing Power of Money (1911). For most economists of that period, money was viewed solely as a means of exchange. The only reason for holding money was to facilitate transactions. Fisher’s analysis commences with a simple identity (a statement that is by definition true), sometimes referred to as the equation of exchange.

MVt ≡ PT where M = Money Supply Vt = Transactions Velocity of Circulation of money (the number of times the money stock changes hands per period). P = Price level. T = The number of Transactions undertaken per period Note that MVt = money stock * number of times the money stock is spent per period = total spending per period. PT = Price of goods & services * volume of goods & services bought per period = total expenditure per period. Thus, at first sight, the Quantity Theory is an innocuous tautology. To turn this identity into a theory of price determination, Fisher made further assumptions about the nature of each variable. M, the money stock was taken to be exogenously determined by the monetary authorities and independent of the other 3 variables Vt, the velocity of circulation was assumed to be more or less constant and was determined by conditions in the financial system that tend to change very slowly. Again, V was thought to be independent of M, P & T. T, the number of transactions per period was also taken as fixed. Recall that Classical scholars believed that in the long term, output tended to be at or near the ECONOMICS KHALID AZIZ 0322-3385752 full employment level. The number of transactions was viewed as fixed at any given level of income.

P, the price level was determined by the interaction of the 3 other factors. Thus, MVt = PT This suggests that the price level is determined by the money supply. Note, T is likely to be extremely difficult to calculate or even conceptualize and V is not an independent variable. Vt is a residual which is generally derived given knowledge of the other 3. i.e. Vt = (PT)/M. (b) The Cambridge Cash Balance Approach. Fisher’s approach can be viewed as deterministic. Essentially, Fisher argued that, given the full employment volume of transactions and the speed with which the financial system could process payments, the quantity of money that agents required to hold was effectively determined. Marshall, Pigou and colleagues took a radically different tack. Like Fisher, the Cambridge School assumed that money was only held to expedite transactions and had no further purpose. Thus, if the money supply increased, agents holding the increased money stock would seek to get rid of it. However, the emphasis in this approach concentrated on establishing the quantity of money that agents would voluntarily desire to hold. The Cambridge school were in effect attempting to set out a theory of the demand for money.

David Laidler (1985) puts it thus “In the Cambridge approach the principle determinant of people’s “taste” for money holding is the fact that it is a convenient asset to have, being universally acceptable in exchange for goods and services. The more transactions an individual has to undertake, the more cash he will want to hold and to this extent the approach is similar to Fisher. The emphasis, however, is on want to hold, rather than have to hold; and this is the basic difference between Cambridge monetary theory and the Fisher framework.” The Cambridge approach emphasises that there are alternatives to holding money in the shape of shares and bonds. These assets yield a return which can be viewed as the opportunity cost of holding money. As interest rates rise, agents will economise on money holdings and vice versa. Another factor that will influence money holdings is the expected rate of inflation. If inflation is expected to be high, then the purchasing power of money will fall. This will prompt agents to buy securities or commodities as a hedge against inflation. ECONOMICS KHALID AZIZ 0322-3385752

We can set out the Cambridge cash balance approach as follows MD = kPy MD = MS Where k = k(E(inf), r, u) This sets out that MD is some fraction k of nominal GDP where k depends on expected inflation, interest rates/returns and u, a set of unspecified factors which may influence money demand. Note that r is a vector of returns reflecting an appreciation that agents had a choice of assets such as shares and bonds. The Cambridge cash balance equation can be recast to facilitate comparison with Fisher’s equation of exchange. MS = kPy = (1/V)Py. In this formulation, V can be construed as the income velocity of circulation. As with the Fisher approach, k was not regarded as fixed but rather was viewed as a stable and predictable function of its determinants. In the long run, changes in the money stock would eventually lead to proportional changes in the price level. The Cambridge approach is universally regarded as the superior account and it forms the basis of later developments in the demand for money by Keynes, Milton Friedman and others. (c) The Transmission Mechanism

The transmission mechanism sets out the process by which a change in the money stock affects economic activity. In the classical context this requires a clear explanation of how ΔM → ΔP. Classical economists argued that there would be both a direct and indirect mechanism. The direct mechanism is the direct influence of a change in M on expenditure and the price level whilst the indirect mechanism operates through the interest rate. To understand this fully, we must be more specific about the definition of money. Money can be narrowly conceived of as notes & coins in circulation. However, bank deposits can also be properly regarded as a component of the money stock. Classical economists focussed on the ability of banks to create money through the expansion of loans. Fisher restated his equation of exchange to incorporate the banking sector. Thus, PT ≡ MV + M’V’ ECONOMICS KHALID AZIZ 0322-3385752 Where M is quantity of currency (termed primary money by Fisher) V is the velocity of circulation of currency M’ is the quantity of bank deposits and V’ is the velocity of circulation of deposit money Assume that M (the quantity of primary money) rises. This could be achieved by the central bank buying bonds and securities from the non bank private sector and paying for these purchases with cash. This would raise prices directly via the direct mechanism. Fisher demonstrated that the emergence of inflation would result in a divergence between the real and nominal rates of interest. Rt = rt + ΔPe t where R is the nominal rate of interest, r is the real rate of interest and ΔPe t is the expected rate of inflation The Classical theorists viewed the interest rate as ‘the reward for waiting’.

If agents were to be persuaded to forego current consumption, they would require to be compensated with greater a greater volume of consumption in a later period. Thus, the real rate of interest reflects the reward in terms of actual goods and services required to persuade agents to save. If r = 5%, this suggests that agents require a 5% more goods and services in future if they are to be tempted to forego 1 unit of current consumption. Note that in the preceding account, prices remained constant. If prices are rising by 5%, the nominal rate of interest would have to be 10% in order to ensure a 5% rise in actual goods and services as a reward for waiting. Hence, Fisher argued that an increase in the primary money stock would initially serve to drive up prices. The increase in inflation would cause the nominal rate of interest to rise above the real rate. However, Fisher contended that the rise in the nominal rate would be insufficient to maintain the real rate at its equilibrium level.

Thus, following a price increase, the real rate of interest would fall. This would result in an increase in the demand for loans by borrowers. Fisher argued that banks would increase the volume of loans at the lower real rate thus increasing the volume of deposits, M’. The expenditure made possible by these loans drives up the price level. Although in the short run, this increased spending may increase the number of transactions, the long run impact of the direct and indirect mechanisms would result in a rise in the price level proportional to the rise in the money supply. Other classical writers such as Knut Wicksell envisaged a role for bank behaviour leading to changes in M resulting in changes in r.

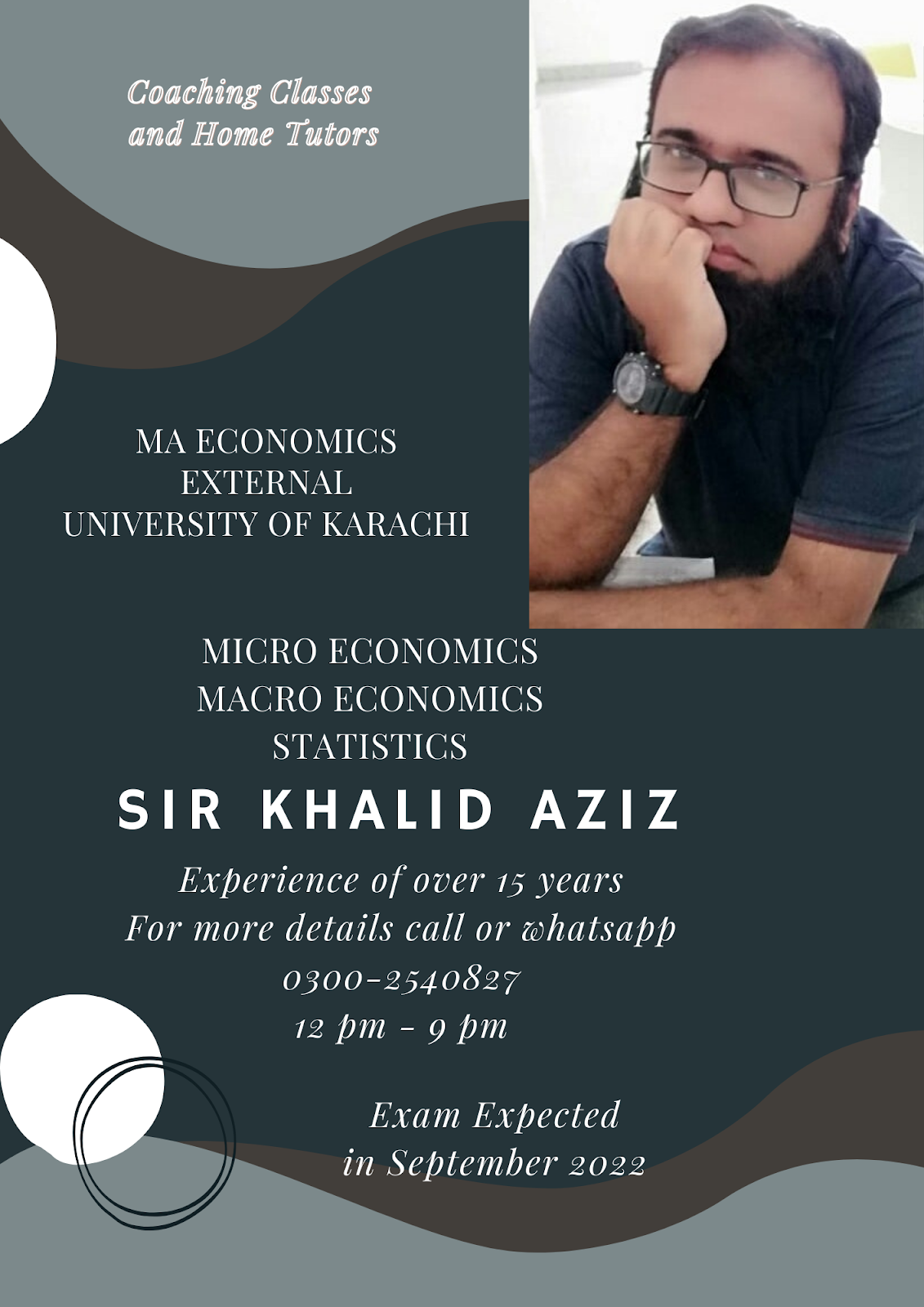

ECONOMICS KHALID AZIZ 0322-3385752 MA ECONOMICS FOR EXTERNAL CANDIDATES KARACHI UNIVERSITY MICRO ECONOMICS & ADVANCED STATISTICS FOR ECONOMICS. (PREVIOUS) MACRO ECONOMICS (FINAL) GUESS PAPERS ALSO AVAILABLE JOIN KHALID AZIZ NOW CONTACT: 0322-3385752 R-1173, ALNOOR SOCIETY, BLOCK 19 F.B.AREA, KARACHI, NEAR POWER HOUSE.

Classical Economics

The Quantity Theory of Money The Quantity Theory of Money seeks to establish that, in the long run, the price level/ rate of inflation is determined by the level/ rate of increase of the money supply. Although the Quantity Theory of Money is an extremely old proposition, it was first formalised in the early part of the 20th century by Yale economist, Irving Fisher and later by a group of Cambridge economists, Alfred Marshall and most notably A. C. Pigou. (a) Fisher’s Transactions Approach This approach first emerged in Fisher’s book The Purchasing Power of Money (1911). For most economists of that period, money was viewed solely as a means of exchange. The only reason for holding money was to facilitate transactions. Fisher’s analysis commences with a simple identity (a statement that is by definition true), sometimes referred to as the equation of exchange.

MVt ≡ PT where M = Money Supply Vt = Transactions Velocity of Circulation of money (the number of times the money stock changes hands per period). P = Price level. T = The number of Transactions undertaken per period Note that MVt = money stock * number of times the money stock is spent per period = total spending per period. PT = Price of goods & services * volume of goods & services bought per period = total expenditure per period. Thus, at first sight, the Quantity Theory is an innocuous tautology. To turn this identity into a theory of price determination, Fisher made further assumptions about the nature of each variable. M, the money stock was taken to be exogenously determined by the monetary authorities and independent of the other 3 variables Vt, the velocity of circulation was assumed to be more or less constant and was determined by conditions in the financial system that tend to change very slowly. Again, V was thought to be independent of M, P & T. T, the number of transactions per period was also taken as fixed. Recall that Classical scholars believed that in the long term, output tended to be at or near the ECONOMICS KHALID AZIZ 0322-3385752 full employment level. The number of transactions was viewed as fixed at any given level of income.

P, the price level was determined by the interaction of the 3 other factors. Thus, MVt = PT This suggests that the price level is determined by the money supply. Note, T is likely to be extremely difficult to calculate or even conceptualize and V is not an independent variable. Vt is a residual which is generally derived given knowledge of the other 3. i.e. Vt = (PT)/M. (b) The Cambridge Cash Balance Approach. Fisher’s approach can be viewed as deterministic. Essentially, Fisher argued that, given the full employment volume of transactions and the speed with which the financial system could process payments, the quantity of money that agents required to hold was effectively determined. Marshall, Pigou and colleagues took a radically different tack. Like Fisher, the Cambridge School assumed that money was only held to expedite transactions and had no further purpose. Thus, if the money supply increased, agents holding the increased money stock would seek to get rid of it. However, the emphasis in this approach concentrated on establishing the quantity of money that agents would voluntarily desire to hold. The Cambridge school were in effect attempting to set out a theory of the demand for money.

David Laidler (1985) puts it thus “In the Cambridge approach the principle determinant of people’s “taste” for money holding is the fact that it is a convenient asset to have, being universally acceptable in exchange for goods and services. The more transactions an individual has to undertake, the more cash he will want to hold and to this extent the approach is similar to Fisher. The emphasis, however, is on want to hold, rather than have to hold; and this is the basic difference between Cambridge monetary theory and the Fisher framework.” The Cambridge approach emphasises that there are alternatives to holding money in the shape of shares and bonds. These assets yield a return which can be viewed as the opportunity cost of holding money. As interest rates rise, agents will economise on money holdings and vice versa. Another factor that will influence money holdings is the expected rate of inflation. If inflation is expected to be high, then the purchasing power of money will fall. This will prompt agents to buy securities or commodities as a hedge against inflation. ECONOMICS KHALID AZIZ 0322-3385752

We can set out the Cambridge cash balance approach as follows MD = kPy MD = MS Where k = k(E(inf), r, u) This sets out that MD is some fraction k of nominal GDP where k depends on expected inflation, interest rates/returns and u, a set of unspecified factors which may influence money demand. Note that r is a vector of returns reflecting an appreciation that agents had a choice of assets such as shares and bonds. The Cambridge cash balance equation can be recast to facilitate comparison with Fisher’s equation of exchange. MS = kPy = (1/V)Py. In this formulation, V can be construed as the income velocity of circulation. As with the Fisher approach, k was not regarded as fixed but rather was viewed as a stable and predictable function of its determinants. In the long run, changes in the money stock would eventually lead to proportional changes in the price level. The Cambridge approach is universally regarded as the superior account and it forms the basis of later developments in the demand for money by Keynes, Milton Friedman and others. (c) The Transmission Mechanism

The transmission mechanism sets out the process by which a change in the money stock affects economic activity. In the classical context this requires a clear explanation of how ΔM → ΔP. Classical economists argued that there would be both a direct and indirect mechanism. The direct mechanism is the direct influence of a change in M on expenditure and the price level whilst the indirect mechanism operates through the interest rate. To understand this fully, we must be more specific about the definition of money. Money can be narrowly conceived of as notes & coins in circulation. However, bank deposits can also be properly regarded as a component of the money stock. Classical economists focussed on the ability of banks to create money through the expansion of loans. Fisher restated his equation of exchange to incorporate the banking sector. Thus, PT ≡ MV + M’V’ ECONOMICS KHALID AZIZ 0322-3385752 Where M is quantity of currency (termed primary money by Fisher) V is the velocity of circulation of currency M’ is the quantity of bank deposits and V’ is the velocity of circulation of deposit money Assume that M (the quantity of primary money) rises. This could be achieved by the central bank buying bonds and securities from the non bank private sector and paying for these purchases with cash. This would raise prices directly via the direct mechanism. Fisher demonstrated that the emergence of inflation would result in a divergence between the real and nominal rates of interest. Rt = rt + ΔPe t where R is the nominal rate of interest, r is the real rate of interest and ΔPe t is the expected rate of inflation The Classical theorists viewed the interest rate as ‘the reward for waiting’.

If agents were to be persuaded to forego current consumption, they would require to be compensated with greater a greater volume of consumption in a later period. Thus, the real rate of interest reflects the reward in terms of actual goods and services required to persuade agents to save. If r = 5%, this suggests that agents require a 5% more goods and services in future if they are to be tempted to forego 1 unit of current consumption. Note that in the preceding account, prices remained constant. If prices are rising by 5%, the nominal rate of interest would have to be 10% in order to ensure a 5% rise in actual goods and services as a reward for waiting. Hence, Fisher argued that an increase in the primary money stock would initially serve to drive up prices. The increase in inflation would cause the nominal rate of interest to rise above the real rate. However, Fisher contended that the rise in the nominal rate would be insufficient to maintain the real rate at its equilibrium level.

Thus, following a price increase, the real rate of interest would fall. This would result in an increase in the demand for loans by borrowers. Fisher argued that banks would increase the volume of loans at the lower real rate thus increasing the volume of deposits, M’. The expenditure made possible by these loans drives up the price level. Although in the short run, this increased spending may increase the number of transactions, the long run impact of the direct and indirect mechanisms would result in a rise in the price level proportional to the rise in the money supply. Other classical writers such as Knut Wicksell envisaged a role for bank behaviour leading to changes in M resulting in changes in r.

ECONOMICS KHALID AZIZ 0322-3385752 MA ECONOMICS FOR EXTERNAL CANDIDATES KARACHI UNIVERSITY MICRO ECONOMICS & ADVANCED STATISTICS FOR ECONOMICS. (PREVIOUS) MACRO ECONOMICS (FINAL) GUESS PAPERS ALSO AVAILABLE JOIN KHALID AZIZ NOW CONTACT: 0322-3385752 R-1173, ALNOOR SOCIETY, BLOCK 19 F.B.AREA, KARACHI, NEAR POWER HOUSE.

Friday, January 6, 2012

Subscribe to:

Posts (Atom)

-

CHIT-CHAT TIME Commerce Heaven (In this conversation after getting 1000 Rupees Khalid is going with his friend Tariq to purcha...

-

MANAGEMENT THEORY OF MARY PARKER FOLLET: Modern management theory owes a lot to a nearly-forgotten woman writer, Mary Parker Follett....

-

Macroeconomic factors overview: The economy of any country, either good or bad, always depends on multiple macroeconomic factors. In orde...

Total Pageviews

CLASSES

Guess Papers