MA ECONOMICS

NOTES AVAILABLE IN REASONABLE PRICE

Macroeconomics and Microeconomics: Chit Chat

CHIT-CHAT TIME Commerce Heaven (In this conversation after getting 1000 Rupees Khalid is going with his friend Tariq to purcha...

Sunday, December 15, 2013

Tuesday, December 3, 2013

Monday, November 18, 2013

Sunday, June 23, 2013

Price Discrimination

price discrimination

A monopolist may be able to engage in a policy of price discrimination. This occurs when a firm charges a different price to different groups of consumers for an identical good or service, for reasons not associated with the costs of production. It is important to stress that charging different prices for similar goods is not price discrimination. For example, price discrimination does not does not occur when a rail company charges a higher price for a first class seat. This is because the price premium over a second-class seat can be explained by differences in the cost of providing the service.

CONDITIONS REQUIRED FOR PRICE DISCRIMINATION TO WORK

There are basically three main conditions required for price discrimination to take place.

Monopoly power

Firms must have some price setting power - so we don't see price discrimination in perfectly competitive markets.

Elasticity of demand

There must be a different price elasticity of demand for the product from each group of consumers. This allows the firm to extract consumer surplus by varying the price leading to additional revenue and profit.

Separation of the market

The firm must be able to split the market into different sub-groups of consumers and then prevent the good or service being resold between consumers. (For example a rail operator must make it impossible for someone paying a "cheap fare" to resell to someone expected to pay a higher fare. This is easier in the provision of services rather than goods.

The costs of separating the market and selling to different sub-groups (or market segments) must not be prohibitive.

Examples of price discrimination

There are numerous good examples of discriminatory pricing policies. We must be careful to distinguish between discrimination (based on consumer's willingness to pay) and product differentiation - where price differences might also reflect a different quality or standard of service.

Some examples worth considering include:

- Cinemas and theatres cutting prices to attract younger and older audiences

- Student discounts for rail travel, restaurant meals and holidays

- Car rental firms cutting prices at weekends

- Hotels offering cheap weekend breaks and winter discounts

The aims of price discrimination

It must be remembered that the main aim of price discrimination is to increase the total revenueand/or profits of the supplier! It helps them to off-load excess capacity and can also be used as a technique to take market share away from rival firms.

Some consumers do benefit from this type of pricing - they are "priced into the market" when with one price they might not have been able to afford a product. For most consumers however the price they pay reflects pretty closely what they are willing to pay. In this respect, price discrimination seeks to extract consumer surplus and turn it into producer surplus (or monopoly profit).

Monday, June 17, 2013

Wednesday, June 12, 2013

Tuesday, May 28, 2013

Thursday, May 23, 2013

MA ECONOMICS SERIES: MACRO ECONOMICS:Concepts of Inflationary and Deflationary GAPS

Concepts of Inflationary and Deflationary GAPS and how these can be wiped out by the government:

National Income and full Employment :-

The most desirable level of national income is that which is equal to the level of full employment. But it is not necessary that equilibrium of national income is always at the level full employment. It may be below the full employment level or above the full employment level. We can bring the savings equal to the investment by employing all the resources of the country, including human resources.

When the national income is below the level of full employment, it means that at the full employment savings are not utilized by the increase in investment. There is gap between full employment, saving and the actual investment taking place.

Deflationary Gap :-

Samulson says, "The size of deflationary gap is measured by the deficiency of investment schedule at full employment saving."

Deflationary gap arises when C + I or aggregate demand is less than the full employment NNP level.

1. Deflationary gap = National income at full employment level - Total expenditure (C+I).

2. Deflationary gap = National saving at the level of full employment - Real investment.

We can explain it by following diagram :

Explanation :- In this diagram national income is measuring along OX - axis and expenditure along OY. The full employment level is on 45 degree line. The aggregate demand curve (C+I) intersects the aggregate supply curve (45 degree line) at the point "B" CD gap is equal to 40 million rupees which represents the deflationary gap. Now the deficiency in national income will not be equal to 40 million. But due to multiplier it will be more than 40 million. For example if multiplier is 4 then deficiency in income will be 4 x 40 = 160. The equilibrium of national income will be 280 - 160 = 120 at the point "B". Noe this gap shows that sources of the country are under utilized. So to fill this gap there is need of increase in investment. There should be an increase of 40 million in investment, if multiplier is 4 , the gap of 160 million in income will be filled and full employment level will be achieved.

Inflationary Gap :-

It is the opposite to deflationary gap. This gap indicates that situation when the saving fall short then scheduled investment at the level of full employment there is said to be an inflationary gap. When the investment is excess then the real savings and it is above the level of employment, is called inflationary gap.

So the excess of consumption and investment (C+I) cover the full employment gap.

The national income here rises in money terms. The value of money falls short and a country is in the grip of inflation. The desired aim is that economy should operate at the level of full employment. The economy should not operate below the level of full employment. There are two methods of measuring the inflationary gap :

Inflationary gap = Total expenditure - National income at the level of full employment.

Inflation gap = Investment in terms of money - real saving at the level of full employment.

Explanation :- The aggregate supply schedule is the 45 degree helping line. It shows the various levels of out put. The aggregate demand (C+I) cuts the aggregate supply curve at the point "B".

At the level of full employment level equilibrium of national income is 280 million rupees, the total expected expenditure (C+I) is 320 million, which is shown between C and D. So 40 million inflationary gap is available, it is excess investment and there is an increase of 160 million in national income but in terms of money. If we want to remove inflationary gap we will have to decrease only 40 million investment.

The most desirable level of national income is that which is equal to the level of full employment. But it is not necessary that equilibrium of national income is always at the level full employment. It may be below the full employment level or above the full employment level. We can bring the savings equal to the investment by employing all the resources of the country, including human resources.

When the national income is below the level of full employment, it means that at the full employment savings are not utilized by the increase in investment. There is gap between full employment, saving and the actual investment taking place.

Deflationary Gap :-

Samulson says, "The size of deflationary gap is measured by the deficiency of investment schedule at full employment saving."

Deflationary gap arises when C + I or aggregate demand is less than the full employment NNP level.

1. Deflationary gap = National income at full employment level - Total expenditure (C+I).

2. Deflationary gap = National saving at the level of full employment - Real investment.

We can explain it by following diagram :

Explanation :- In this diagram national income is measuring along OX - axis and expenditure along OY. The full employment level is on 45 degree line. The aggregate demand curve (C+I) intersects the aggregate supply curve (45 degree line) at the point "B" CD gap is equal to 40 million rupees which represents the deflationary gap. Now the deficiency in national income will not be equal to 40 million. But due to multiplier it will be more than 40 million. For example if multiplier is 4 then deficiency in income will be 4 x 40 = 160. The equilibrium of national income will be 280 - 160 = 120 at the point "B". Noe this gap shows that sources of the country are under utilized. So to fill this gap there is need of increase in investment. There should be an increase of 40 million in investment, if multiplier is 4 , the gap of 160 million in income will be filled and full employment level will be achieved.

Inflationary Gap :-

It is the opposite to deflationary gap. This gap indicates that situation when the saving fall short then scheduled investment at the level of full employment there is said to be an inflationary gap. When the investment is excess then the real savings and it is above the level of employment, is called inflationary gap.

So the excess of consumption and investment (C+I) cover the full employment gap.

The national income here rises in money terms. The value of money falls short and a country is in the grip of inflation. The desired aim is that economy should operate at the level of full employment. The economy should not operate below the level of full employment. There are two methods of measuring the inflationary gap :

Inflationary gap = Total expenditure - National income at the level of full employment.

Inflation gap = Investment in terms of money - real saving at the level of full employment.

Explanation :- The aggregate supply schedule is the 45 degree helping line. It shows the various levels of out put. The aggregate demand (C+I) cuts the aggregate supply curve at the point "B".

At the level of full employment level equilibrium of national income is 280 million rupees, the total expected expenditure (C+I) is 320 million, which is shown between C and D. So 40 million inflationary gap is available, it is excess investment and there is an increase of 160 million in national income but in terms of money. If we want to remove inflationary gap we will have to decrease only 40 million investment.

Tuesday, May 14, 2013

Sunday, April 28, 2013

Wednesday, April 24, 2013

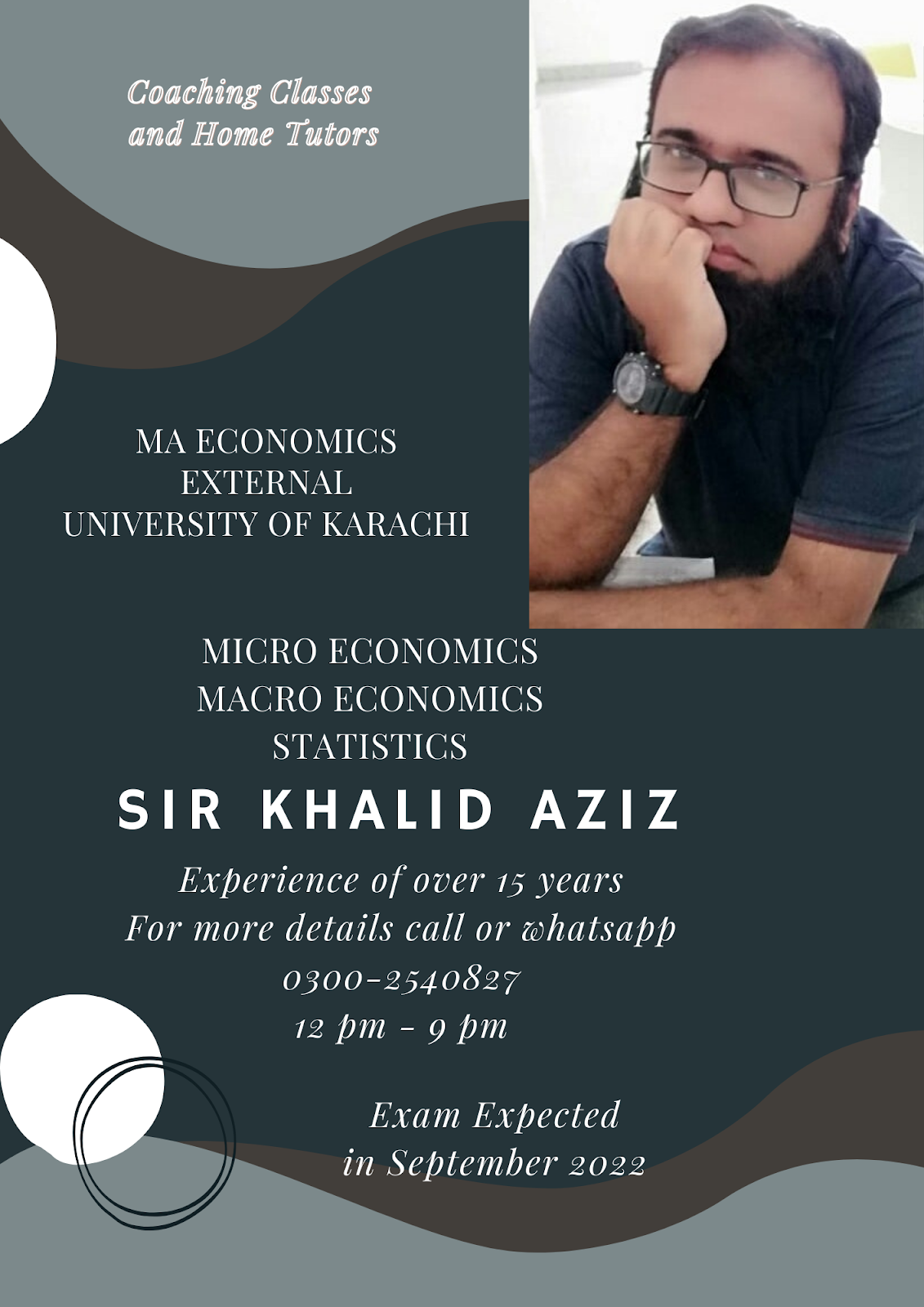

MA_ECONOMICS PRIVATE GUESS PAPERS ARE AVAILABLE

MA-ECONOMICS EXTERNAL PAPER III

STATISTICS

SPECIAL CLASSES

12 DAYS

JOIN NOW

KHALID AZIZ

0322-3385752

R-1173, AL-NOOR SOCIETY, BLK 19,NEAR POWER HOUSE & MASJID E AQSA, F.B.AREA, KARACHI.

$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$4

MA ECONOMICS PRIVATE KARACHI UNIVERSITY...PREVIOUS AND FINAL...GUESS PAPERS ARE AVAILABLE. 4pm-9pm

KHALID AZIZ

0322-3385752

R-1173, 3RD FLOOR ALNOOR SOCIETY BLOCK 19,F,B,AREA NEAR POWER HOUSE AND MASJID E AQSA.

KHALID AZIZ

0322-3385752

R-1173, 3RD FLOOR ALNOOR SOCIETY BLOCK 19,F,B,AREA NEAR POWER HOUSE AND MASJID E AQSA.

Tuesday, April 16, 2013

Sunday, March 24, 2013

DATE OF SUBMISSION OF EXAMINATIONS FORMS OF MA EXTERNAL KARACHI UNIVERSITY IS EXTENDED

DATE OF SUBMISSION OF EXAMINATIONS FORMS OF MA EXTERNAL KARACHI UNIVERSITY IS EXTENDED:

Tuesday, March 5, 2013

Sunday, February 24, 2013

Thursday, January 31, 2013

KARACHI UNIVERSITY HAS ANNOUNCED RESULTS OF MA EXTERNAL FINAL-ECONOMICS

KARACHI UNIVERSITY HAS ANNOUNCED RESULTS OF MA EXTERNAL FINAL-ECONOMICS:

RESULT MA-ECO FINAL

http://www.uok.edu.pk/ann_results/docs/2013/mafext11a.pdf

RESULT MA-ECO FINAL

http://www.uok.edu.pk/ann_results/docs/2013/mafext11a.pdf

Subscribe to:

Comments (Atom)

-

CHIT-CHAT TIME Commerce Heaven (In this conversation after getting 1000 Rupees Khalid is going with his friend Tariq to purcha...

-

Definition and Explanation: Classic economics covers a century and a half of economic teaching. Adam Smith wrote a classic book entitled, ...

-

Offer Curve Diagram Tariff A B A&B Expansion A B A&B Variants: Inelastic Demand by ... Country A...

Total Pageviews

CLASSES

Guess Papers

.gif)