MA ECONOMICS

NOTES AVAILABLE IN REASONABLE PRICE

Macroeconomics and Microeconomics: Chit Chat

CHIT-CHAT TIME Commerce Heaven (In this conversation after getting 1000 Rupees Khalid is going with his friend Tariq to purcha...

Tuesday, May 28, 2013

Thursday, May 23, 2013

MA ECONOMICS SERIES: MACRO ECONOMICS:Concepts of Inflationary and Deflationary GAPS

Concepts of Inflationary and Deflationary GAPS and how these can be wiped out by the government:

National Income and full Employment :-

The most desirable level of national income is that which is equal to the level of full employment. But it is not necessary that equilibrium of national income is always at the level full employment. It may be below the full employment level or above the full employment level. We can bring the savings equal to the investment by employing all the resources of the country, including human resources.

When the national income is below the level of full employment, it means that at the full employment savings are not utilized by the increase in investment. There is gap between full employment, saving and the actual investment taking place.

Deflationary Gap :-

Samulson says, "The size of deflationary gap is measured by the deficiency of investment schedule at full employment saving."

Deflationary gap arises when C + I or aggregate demand is less than the full employment NNP level.

1. Deflationary gap = National income at full employment level - Total expenditure (C+I).

2. Deflationary gap = National saving at the level of full employment - Real investment.

We can explain it by following diagram :

Explanation :- In this diagram national income is measuring along OX - axis and expenditure along OY. The full employment level is on 45 degree line. The aggregate demand curve (C+I) intersects the aggregate supply curve (45 degree line) at the point "B" CD gap is equal to 40 million rupees which represents the deflationary gap. Now the deficiency in national income will not be equal to 40 million. But due to multiplier it will be more than 40 million. For example if multiplier is 4 then deficiency in income will be 4 x 40 = 160. The equilibrium of national income will be 280 - 160 = 120 at the point "B". Noe this gap shows that sources of the country are under utilized. So to fill this gap there is need of increase in investment. There should be an increase of 40 million in investment, if multiplier is 4 , the gap of 160 million in income will be filled and full employment level will be achieved.

Inflationary Gap :-

It is the opposite to deflationary gap. This gap indicates that situation when the saving fall short then scheduled investment at the level of full employment there is said to be an inflationary gap. When the investment is excess then the real savings and it is above the level of employment, is called inflationary gap.

So the excess of consumption and investment (C+I) cover the full employment gap.

The national income here rises in money terms. The value of money falls short and a country is in the grip of inflation. The desired aim is that economy should operate at the level of full employment. The economy should not operate below the level of full employment. There are two methods of measuring the inflationary gap :

Inflationary gap = Total expenditure - National income at the level of full employment.

Inflation gap = Investment in terms of money - real saving at the level of full employment.

Explanation :- The aggregate supply schedule is the 45 degree helping line. It shows the various levels of out put. The aggregate demand (C+I) cuts the aggregate supply curve at the point "B".

At the level of full employment level equilibrium of national income is 280 million rupees, the total expected expenditure (C+I) is 320 million, which is shown between C and D. So 40 million inflationary gap is available, it is excess investment and there is an increase of 160 million in national income but in terms of money. If we want to remove inflationary gap we will have to decrease only 40 million investment.

The most desirable level of national income is that which is equal to the level of full employment. But it is not necessary that equilibrium of national income is always at the level full employment. It may be below the full employment level or above the full employment level. We can bring the savings equal to the investment by employing all the resources of the country, including human resources.

When the national income is below the level of full employment, it means that at the full employment savings are not utilized by the increase in investment. There is gap between full employment, saving and the actual investment taking place.

Deflationary Gap :-

Samulson says, "The size of deflationary gap is measured by the deficiency of investment schedule at full employment saving."

Deflationary gap arises when C + I or aggregate demand is less than the full employment NNP level.

1. Deflationary gap = National income at full employment level - Total expenditure (C+I).

2. Deflationary gap = National saving at the level of full employment - Real investment.

We can explain it by following diagram :

Explanation :- In this diagram national income is measuring along OX - axis and expenditure along OY. The full employment level is on 45 degree line. The aggregate demand curve (C+I) intersects the aggregate supply curve (45 degree line) at the point "B" CD gap is equal to 40 million rupees which represents the deflationary gap. Now the deficiency in national income will not be equal to 40 million. But due to multiplier it will be more than 40 million. For example if multiplier is 4 then deficiency in income will be 4 x 40 = 160. The equilibrium of national income will be 280 - 160 = 120 at the point "B". Noe this gap shows that sources of the country are under utilized. So to fill this gap there is need of increase in investment. There should be an increase of 40 million in investment, if multiplier is 4 , the gap of 160 million in income will be filled and full employment level will be achieved.

Inflationary Gap :-

It is the opposite to deflationary gap. This gap indicates that situation when the saving fall short then scheduled investment at the level of full employment there is said to be an inflationary gap. When the investment is excess then the real savings and it is above the level of employment, is called inflationary gap.

So the excess of consumption and investment (C+I) cover the full employment gap.

The national income here rises in money terms. The value of money falls short and a country is in the grip of inflation. The desired aim is that economy should operate at the level of full employment. The economy should not operate below the level of full employment. There are two methods of measuring the inflationary gap :

Inflationary gap = Total expenditure - National income at the level of full employment.

Inflation gap = Investment in terms of money - real saving at the level of full employment.

Explanation :- The aggregate supply schedule is the 45 degree helping line. It shows the various levels of out put. The aggregate demand (C+I) cuts the aggregate supply curve at the point "B".

At the level of full employment level equilibrium of national income is 280 million rupees, the total expected expenditure (C+I) is 320 million, which is shown between C and D. So 40 million inflationary gap is available, it is excess investment and there is an increase of 160 million in national income but in terms of money. If we want to remove inflationary gap we will have to decrease only 40 million investment.

Subscribe to:

Comments (Atom)

-

CHIT-CHAT TIME Commerce Heaven (In this conversation after getting 1000 Rupees Khalid is going with his friend Tariq to purcha...

-

Definition and Explanation: Classic economics covers a century and a half of economic teaching. Adam Smith wrote a classic book entitled, ...

-

Offer Curve Diagram Tariff A B A&B Expansion A B A&B Variants: Inelastic Demand by ... Country A...

Total Pageviews

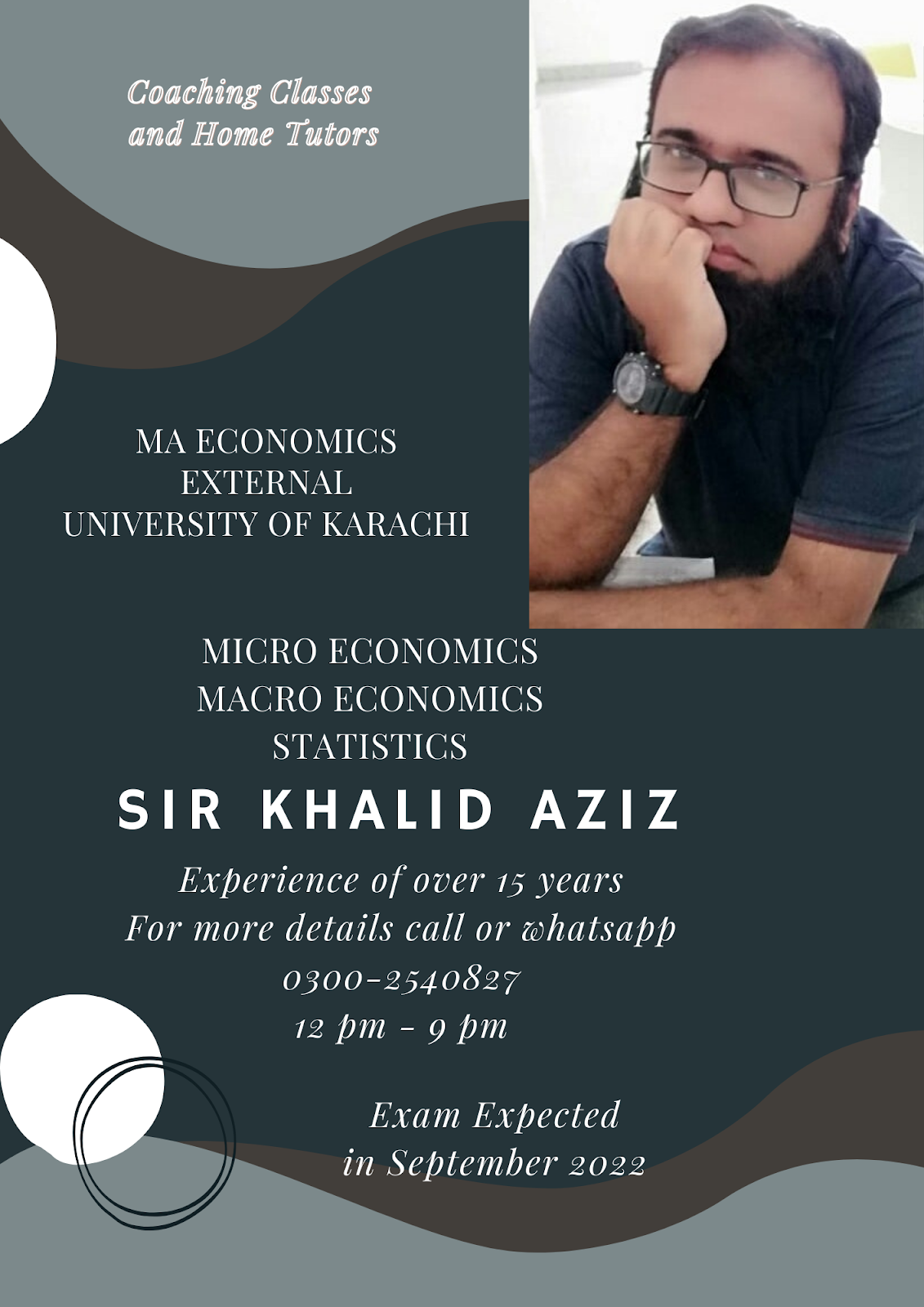

CLASSES

Guess Papers