Economics is a subject notoriously difficult to define clearly for outsiders: a formal definition might be that it

is a social science that deals with the production, consumption and distribution of goods and services; in

simpler terms it deals with how people produce and work, in order to survive in this world. Mainstream

economics covers things such as how prices are determined in the market; how best to organise the economy

for efficiency and growth, and what sort of things can prevent a perfect solution; how wages are determined;

what causes undesirable events like inflation and unemployment and what can be done about it; and how and

why countries interact through foreign trade and foreign investment.

Sciences attempt to be value-free and objective; economics is no exception, and for this reason words like

“ought” or “should” tend to be avoided, as they are normative and the discipline sticks to facts which are

positive. It has to be confessed that it is harder to be completely objective in the social sciences, dealing as

they do with human beings and their behaviour, than in the natural sciences, which are concerned with the

inanimate world and non-human life forms.

In life we constantly make choices and each time we decide to do something, let us call it “X”, then we choose

not to do something else, we can call “Y”. Economists refer to this as the opportunity cost, i.e., what is given

up to get what is actually chosen. It is most clearly seen when constructing a budget and deciding how to

allocate money between competing uses, but it applies everywhere. It lies behind all cost calculations and cost

curve diagrams: the cost is the price that has to be paid for person A to get to use the stuff (iron ore, the service

of a worker, a delivery truck…) rather than let someone else (B) use it.

The study of the economy is traditionally divided into two sections, microeconomics, which looks at bit of the

economy (think of looking down a microscope at something small), especially prices, what firms decide to do

about price and output decisions, and wage determination. Then there is macroeconomics, which looks at the

entire economy and as such is concerned with the size of total output, the level of inflation, the amount of

unemployment, and also foreign trade. We will look at these in turn.

The determination of prices in the market and the system known as the price mechanism

Students used to be taught to chant in unison “prices are determined by demand and supply” and no doubt

some still are. If we take an object (again we shall call it X) if no one wants it at all, then it has no price – there

simply is no demand. Probably a wrecked and burnt out car would fit this description. If some people want X

then it will have a price, as whoever owns X can sell it and use the proceeds for some purpose or other. Will

the price be high or low? It all depends on supply and demand. Think of an auction: if there are four old pianos

for sale and 12 people really want to buy one, the price will be bid up and up, and therefore be high. Supply

and demand! But if there are 20 pianos for sale and again 12 people want a piano, the price of each will be low.

That is the way that prices are roughly determined in the world. We use diagrams to show and analyse this.

An increase in demand occurs if at the auction next week, say, 18 people turn up wanting a piano and there are

still only 4 instruments to bid on. This increase in demand leads to an increase in the price of the pianos. Again

comparing with the first week, a decrease in demand would occur if only 2 people turn up wanting a piano

rather than 12, which would lead to a lower price than in the week before.

A decrease in supply? Instead of four pianos, the number falls, say to one, and with an unchanged number

trying to buy one, the price will increase. Correspondingly, an increase in supply (with unchanged demand)

causes a fall in price.

These simple examples illustrate the working of supply and demand, which operates outside auction rooms as

well as inside them. Notice that the process of the analysis is to start in equilibrium then alter just one element,

holding all the other features unchanged. In economics we mostly do this and then look at the result. This is

called comparative statics: “comparative” because we compare two equilibrium states; and “static” because

everything works through to equilibrium where things cease to change. Dynamic analysis is different as things

keep altering over time. A course in elementary economics does not get this far.

There is one objection to the theory of price setting which on the surface seems valid, but is in fact false. Some

object that firms set prices and that is all there is to it – the theory of price is just wrong. However, if we think

about it, if a firm sets it too high it will wind up with unsold stock, which is costly to store, but if it sets it too

low the firm will run out quickly. Either way the firm could do better: it is not profit maximising. If firms want

to do as well as they can, they have to set a price that just clears the market, i.e. they sell it all but only just.

So it’s back to supply and demand! What if they do not profit maximise? Competition will eventually force

them out of business. It is no accident that most economists have an inbuilt urge to promote competition

wherever possible. Only those economists paid by organisations trying to cling on to a monopoly position tend

to be against it. Are they bad economists? No, just like lawyers, they are paid to promote the interests of their

client but they do not have to believe it implicitly. We will not even think about political spin-doctors.

What about the operation of the price mechanism (market mechanism)?

When a firm believes that it can make a profit by producing something, X, which perhaps has a relatively high

price the firm moves in and does so. This increases the supply of X and drives the price down. As different

firms in different industries constantly chase profits in this way, resources (land, labour and capital) keep

being reallocated from what they are producing to doing something else, as someone hopes that will make

more profit. In this way, the price mechanism allocates resources to where they are most needed and high

prices (indicating that people want to buy X), along with potentially high profits, act as signals to producers.

Why did I say earlier “this is the way that prices are roughly determined in the world”? Because things get in

the way to prevent a perfect solution, particularly for society. Let us list some of these.

1. Some people own all or most of X so they can dribble it onto the market at a slow rate and get a higher price

as a result (monopoly).

2. Some people do not know what is available and where it is to be bought so they do not demand X at all

(information failure).

3. Some people have a lot of money and others have little or none (unequal income distribution) so that a few

incredibly expensive cars, watches, yachts and the like are produced – there is a demand from the rich for these.

But on the other hand, little food is grown and some people are hungry or starve; these are the really poor, who

cannot afford to buy food, or at least not enough food.

4. Some people will not move from where they live to get a job elsewhere. The result is that firms trying to

expand are unable to find enough workers (factor immobility).

5. Some goods and services are provided in too small quantities for what are perceived as the needs of society,

perhaps like health and education (merit goods). Contrariwise, some goods and services may be overconsumed

for society, perhaps cigarettes and alcohol, which contribute to ill-health and accidents in a country

(demerit goods).

6. Some goods and services might be needed by society as a whole but few individuals or none can or will buy

them. Examples include the defence of the country, a police force, a court system for settling disputes, or street

lighting (public goods).

7. Some goods and services, when consumed, might have an impact on people other than the person

consuming (externalities). Common examples of this are pollution, congestion, noise, and litter. Such external

diseconomies are common; but external economies that when consumed by X provide benefit to others may

exist. These might include such things as:

· Training and education: when one firm trains workers and they leave, other firms get the benefit.

· Public education is widely believed to benefit society, so that many countries provide at least

elementary education for free, outside the market system.

· Television and radio broadcasting for spreading information quickly – again many countries provide

at least on channel without charge.

· Health provision: quickly treat those with tuberculosis and it does not spread to others.

All the above points prevent a free market system from reaching a perfect solution as to what shall be produced

and in what amounts.

Wages and wage determination

Wages, like prices, are roughly determined by supply and demand. Again “roughly” as several factors get in

the way of a pure market solution. The demand side comes from firms and organisations who want to hire

people to work for them. The firm, if trying to be as efficient as possible, hires people until finally someone

adds less revenue to the firm than it has to pay as that person as a wage. In the jargon it is called when the

marginal product equals the wage

On the supply side there may be all kinds of restrictions

Obvious ones include differences in intelligence, paper qualifications (degrees, diplomas, in the UK GCE

results…), physical strength, and the completion of a specified training programme, previous experience, and

so forth. The need to meet such criteria tends to mean fewer people may be qualified or able to do a particular

job.

We can list a few more general factors that can affect supply and prevent wage equality.

1. Non-competing groups: shelf-stackers in a supermarket do not compete for work with neurosurgeons in

hospitals. A shortage of surgeons does not lead to shelf-stackers applying to do operations and increasing the

supply of surgeons.

2. Trade union and government restrictions: may intervene in the process by establishing a minimum wage.

The result of this usually means less employment of people overall, but a greater reward for those who can

actually find a job.

3. Labour immobility: people will not always move to a new job. The reasons may include:

· Information failure (people unemployed in locality X do not know about jobs and conditions in locality

Y).

· Local factors that restrict movement, e.g. people with a state-supplied cheap house in X will not give

it up to move to Y.

· Pension schemes – workers who have paid in for years may lose some or all their pension if they move.

· Social groups like family and friends or members of clubs – few people like leaving them and going

off to new and unknown pastures.

· Racial or religious ties to an area.

4. Time lags: it can take years before people become aware of problems and opportunities, consider the matter

carefully, and decide to change their occupation or move to a new area.

5. Non-monetary rewards: it is clear that not all human beings strive to make as much money as possible and

some will take work that gives them satisfaction at a low wage. If this is not true, it is not easy to explain

convincingly why so many choose to become teachers or nurses, or why some drop out of highly-paid

positions in the finance industry in order to take up furniture-making and the like for a living.

Competitive circumstances and the theory of the firm

As noted, economists generally prefer more competition rather than less. Three different states of competition

are widely recognised:

1. Perfect competition, which is at one end of the spectrum and, as the name suggests, is the most competitive

situation of all.

2. Monopoly, or one firm supplying all (or almost all) of the output at the other end of the spectrum; and

3. Imperfect competition (also known as monopolistic competition) which is the bit in the middle; it is fairly

competitive but with some restrictive features.

More minor variants, such as duopoly (two firms), and oligopoly (a few firms make up the industry, which is

reasonably common in reality) exist but attention focuses on the main three above. In economic theory,

attention is paid to the determination of price and output under each of these three different competitive

situations.

Under perfect competition, price is the lowest and output is not restricted at all; resources are well allocated,

although of the things that get in the way listed above, the items 3-7 above that prevent the price mechanism

working properly can still produce a less than perfect allocation of resources.

Under monopoly, price and profits will be the highest and output will be deliberately restricted to achieve this;

resources will be poorly allocated and income distribution will be worsened, as the monopolist really coins it.

With imperfect competition we are in the middle, i.e. middling prices and some output restriction; resources

are reasonably well allocated to the demands of consumers but less so than with perfect competition and there

will be some short-term widening of the distribution of income. Some observers claim there will also be faster

growth in total output as the short-term high profits can be used for research and development, plus there is

enough competition between firms to ensure that each tries hard.

Production theory

The theory of production deals with the use of factors of production (land, labour and capital), how much of

each a firm will choose to use, with much attention paid to the case of labour. This, via something called

marginal productivity, or how much the last person employed adds to total production, provides the

foundation for wage theory. The law of diminishing returns states that after an initial period, the amount added

to total output by each extra person must fall. From this we get the demand curve for labour, needed in wage

theory (above).

The decision on how many people to employ and how much capital (the choice of technique) also derives from

the theory of production; simply put, in an environment with a lot cheap labour, as found in many poor

developing countries, firms use more people and less capital (labour intensive techniques) but in rich

industrialised countries the reverse is the case (capital intensive techniques).

Managing the economy as a whole (macroeconomics)

There are 10 major goals, or economic areas of concern, that all governments in all countries can have. Each

government, and political party, can choose which of them to place stress on, and which to take more lightly.

Because some of the goals clash, a choice between them is often necessary. Each government or party could,

and perhaps should, prioritize these in their preferred order, but few probably do. The way it mostly seems to

work is that there are often a few main policies established as central and from then on, the party or

government may well be reactive, responding to events rather than being proactive and setting things running.

So what are these 10 main economic goals?

1. Inflation – avoiding or reducing it.

2. Unemployment – often reducing the level, but sometimes deliberately doing the opposite to cool down an

over-heated economy.

3. Economic growth – usually increasing it.

4. The balance of payments – either balancing it or aiming for a small surplus.

5. The value of the currency – in the UK this means maintaining the value of the pound, in the USA the value

of the dollar, and so forth.

6. Improving the allocation of resources – this often means moving towards a more competitive marketdetermined

solution; but the government has its own agenda too, such as it may wish to increase resources to

education, defence, or the National Health Service.

7. The distribution of income – this often means trying to make it more equal, or at least paying lip-service

to this.

8. The standard of living – a high standard of living is preferred, so increasing the level is often a goal.

9. Taking care of the environment – this is a relatively new goal, but one that is rapidly increasing in importance.

10. Avoiding unnecessary and undesired fluctuations in the above nine points.

As a quiet bit of fun, take a couple of minutes and pretend you are the Prime Minister, President, or person in

charge of your country, and to see what priority order you yourself would choose. Then look at “Why it is

difficult to get it just right” below. Being in charge is not always an easy job!

How can government try to manage the economy?

In a market economy there are only two main ways: monetary policy (altering the supply of money or the rate

of interest) and fiscal policy (altering the level or structure of taxation).

In the case of monetary policy, since 1997 the government in the UK lost the ability to directly alter the rate

of interest when it gave authority to the Bank of England’s Monetary Policy Committee to do this, although

it is represented on the Committee. The central goal of this Committee is inflation; it attempts to keep it within

one per cent of the annual goal set by the Chancellor of the Exchequer. The other goals of government are not

the concern of the Committee.

In the UK, fiscal policy is administered largely through the annual budget, in April each year. Such once-ayear

changes do not provide a flexible policy tool, but the effects do come into play quickly, which is good.

Both these policies are used to alter the level of aggregate demand (the total level of private spending on

consumption and investment, plus all government expenditure, including export earnings minus import

leakages) in the desired direction, if the government wishes to depress the economy, it reduce aggregate

demand which will depress the rate of inflation, increase the level of unemployment, and improve the balance

of payments. The authorities can do this by increasing the level of taxation (fiscal policy) or the rate of interest

(monetary policy). Both measures take money out of the economy: extra tax to pay means less discretionary

spending is possible, whereas increasing the rate of interest means that repayments on many borrowings,

including the important mortgage repayments, increase (which leaves less in the pocket for consumers to

spend). It also means that firms wishing to borrow to expand or to fund the purchase of machinery etc.) find

it will cost them more, so they postpone it wherever possible (reduced spending on investment).

Why it is difficult to get it just right

1. Information lags – we do not ever know where the economy actually is when a decision has to be made.

2. Information reliability – errors creep in; there never really is totally accurate information available.

“Garbage in, garbage out” then applies.

3. Different policy measures have different time lags before they take full effect. This means that as policy

changes some older measures probably have not fully worked through, the new measures kick in, and at

varying speeds, so we tend to blunder along. Hopefully we are going in the right direction although this is not

always certain until later on.

4. Some goals contradict, so that there is no way of “getting it right” anyway! As one example, under normal

circumstances, if we increase the level of aggregate demand to lower unemployment it tends to increase the

rate of inflation, which in turn tends to reduce exports and increase imports, worsening the balance of

payments. It also increases output and tends to widen the distribution of income.

5. We are not smart enough to get it right. As we are dealing with human beings and they have freedom to

make new decisions and change, it is possible that we never will be. The historical record of what happens

when we changed the rate of interest by half a percent may not apply next time.

The foreign sector: trade and investment

All the above was concerned with a domestic economy in isolation. In reality, no country is alone in the world

and few wish to be isolated. There is a high economic price to be paid for isolation: slow growth, great

inefficiency, and a low standard of living. Most countries choose to trade with others as a result.

Why do they do it? What are the gains from trade?

1. Comparative advantage – a country produces what it is good at (agricultural produce, light industrial goods,

services such as banking and finance….) and sells these to the world. It then imports what it is not so good at

from those countries which can produce the item more efficiently and cheaply. This explanation is the main

reason for trade. If all countries were equally good at everything, why bother to trade? As a personal example,

if you are extremely good at playing football and a rotten cook, it pays to earn a substantial income playing

sport and eat out at restaurants or employ your own cook. Your comparative advantage is on the sports field

not in the kitchen.

2. Economies of scale – if it is cheaper per item to produce in vast amounts, then countries can specialise in

a few things and sell them to others in exchange for things that the other countries specialise in.

3. Variety – consumers in a country might enjoy some foreign products, import them, and sell stuff in return.

Motorcar production in Europe springs to mind as a possible example as each country buys cars from the others.

4. Sheer absence of an item – it is difficult to grow bananas in Iceland or make refrigerators in the Saharan

desert, so things that are lacking may be imported. Note that it is not impossible to do this, merely very

expensive to do so, which means that this is often really a specific case of comparative advantage.

Despite the established benefits of trade, there seems to be a widespread instinct towards protecting the

economy from foreign competition, i.e. protecting jobs and protecting the profit of domestic companies. Each

individual sector would like to be protected, although it does not mind much if all other sectors are not. In fact,

this would be the best outcome for the small protected part, as it would gain all the benefits of cheaper goods

and services plus rapid economic growth, but without giving up a thing.

Since the end of World War Two, economies have gradually opened up and reduced the level protection

although not at a steady rate. The views of economists, pressure from politicians such as Margaret Thatcher

and Ronald Reagan, negotiations via a series of meetings at the international level, and the widespread but not

complete collapse of communism, have all played a part.

Globalisation is the ultimate stage of this process of opening up domestic economies by reducing protection,

increasing foreign trade, and liberalising the flows of foreign investment. The world as a whole benefits from

this; but there can be, and are, losses to some. At the national level, things get in the way of a perfect market

solution, and the same is true of the world as a whole. While companies in major, powerful, and rich countries

gain from investing in poor countries, the local people may suffer. The influx of foreign capital can easily

damage or destroy the existing local industry and agriculture. It is a specific case of a poor market solution

when faced with an extremely wide income distribution but it is now on the global scale – the market operates

to supply what is demanded by those with the money to spend. Those with little or no money have little or no

say in the pattern of consumption and, ultimately, in what people choose to produce in order to sell. So with

globalisation some of the really poor countries and their peoples may lose out; many of those living in richer

countries (including many of their poor) definitely gain; and the world as a whole is certainly better off.

Is globalisation then acceptable? Is it fair or just? This is an emotive issue in which morals, ethics, and values

are often hotly debated. Those institutions that work to reduce protection and increase globalisation, such as

the World Trade Organisation, are often attacked verbally and their officials physically. The antagonists are

people who hold strong, some would say extreme, views that globalisation hurts the poor and is simply all

wrong. The protagonists say that the world as a whole benefits and most are better off. The reply to this is that

some are definitely made worse off, they are already the weak, the poor, and the suffering and they are not

compensated by the greedy and selfish winners. Some respond to this view that that is just the way the world

is, and in addition, there is no going back. The reply to this response may well be unprintable.

It has to be stated that economics, and the workings of an economy, are amoral; morality, ethics and justice

do not appear. We believe that the price mechanism, free trade, and ultimately globalisation produce a more

efficient system, a higher standard of living, and faster economic growth which all work for the benefit of

many. But it involves losers too and these are too often the poorest amongst us and the least able to cope.

How do we measure the degree of interaction with other countries?

This is done in the balance of payments, an account that shows our financial dealings with the rest of the world.

It was traditionally divided into two parts, the current account, which includes trade in goods (that we can see)

and services (that we cannot look at as such); and the capital account, which roughly explained how the current

account was financed. If imports exceed exports, a country either pays the difference by transferring foreign

exchange or else borrows to cover this difference. (A popular exam question was to explain how the entire

balance of payments could be described as in balance when there was a clear surplus or deficit in the current

account; well you either pay the debt or still owe it!)

Since 1998 the UK has adopted a four part approach to the balance of payments but the distinction between

current and capital account persists.

1. The current account: the export and import of goods and services + incomes flowing to and from abroad,

earned by workers and also from investments.

2. The capital account: changes in the financial size of ownership of fixed assets and what migrants bring in

and take out as they come and go.

3. The financial account: changes in the financial size of assets the UK residents buy abroad and foreign

abroad buy in the UK.

4. The international investment position: the total stock of assets that UK residents own abroad and foreign

residents own in the UK. The first three items are money flows, not stocks.

Which part of the balance of payments matters? All of it. We look at the part of the balance of payments that

gives us the answer to whatever question we are interested in. Having said that, attention mostly focuses on

the current account and changes in it, because it shows how well we are currently doing.

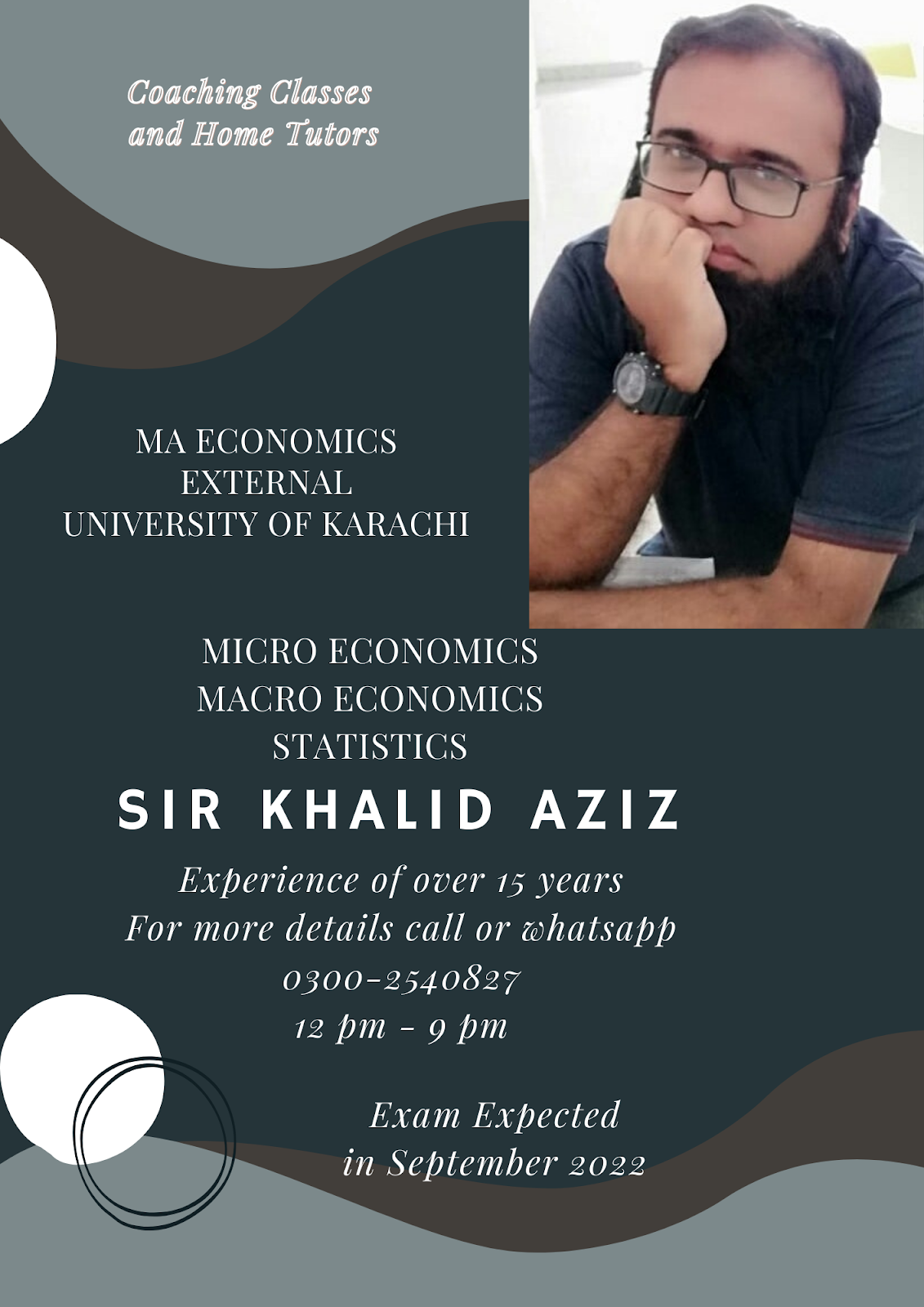

MA ECONOMICS

NOTES AVAILABLE IN REASONABLE PRICE

Macroeconomics and Microeconomics: Chit Chat

CHIT-CHAT TIME Commerce Heaven (In this conversation after getting 1000 Rupees Khalid is going with his friend Tariq to purcha...

Subscribe to:

Post Comments (Atom)

-

CHIT-CHAT TIME Commerce Heaven (In this conversation after getting 1000 Rupees Khalid is going with his friend Tariq to purcha...

-

Definition and Explanation: Classic economics covers a century and a half of economic teaching. Adam Smith wrote a classic book entitled, ...

-

Offer Curve Diagram Tariff A B A&B Expansion A B A&B Variants: Inelastic Demand by ... Country A...

Total Pageviews

CLASSES

Guess Papers

No comments:

Post a Comment