1. Cost of Service Principle: This principle states that it would be just if people are charged the cost of the service rendered to them. This principle has no practical application. The cost of service of armed forces, police, etc. – the services which are rendered out of tax proceeds – cannot be exactly determined. Only in those cases, where the services are rendered out of prices, e.g., supply of electricity, railway or postal service, a near approach can be made to charging according to the cost of service.

2. Benefit or Quid Pro Quo Theory: This theory suggests that the taxes should be levied according to the benefit conferred on the tax-payers. But its practical application is also difficult. Most of the public expenditure is incurred for common or indivisible benefits. It is impossible to calculate how much benefit accrues to a particular individual. There are a few cases only where the benefit to one individual is ascertainable, e.g., old-age pensions. The benefit theory violates the basic principle of tax. A tax is paid for the general purposes of the State and not in return for a specific service. Moreover, it is commonly believed that the poor benefit more from the State activities than the rich. If that is so, then the poor has to contribute more than the rich. This would be absurd. However, the idea of benefit stands out prominently in the case of fees, licences, special assessment and local rating.

3. Ability to Pay or Faculty Theory: This is the most popular and the plausible theory of justice in taxation is that every tax-payer should be made to contribute according to his ability or faculty to pay. The difficult task is to determine a person’s ability to pay tax. There are two approaches for this theory – subjective and objective:

(i) Subjective Approach: In the subjective aspect, the inconvenience, the pinch or the sacrifice bear by tax-payer is considered. There are three distinct views in this regard:

(a) (a) The Principle of Equal Sacrifice: According to J.S. Mill, equality of taxation, as a maxim of politics, means equality of sacrifice. According to this principle, the money burden of taxation is to be so distributed as to impose equal real burden on the individual tax-payers. This would mean proportional taxation.

(b) (b) The Principle of Proportional Sacrifice: According to the principle of proportional sacrifice, the real burden on the individual tax payer is to be not equal but proportional either to their income or the economic welfare they derive. This would mean progressive taxation.

(c) (c) The Principle of Minimum Sacrifice: The minimum sacrifice principle considers the body of tax-payers in the aggregate and not individually. According to this principle, the total real burden on the community should be as small as possible.

(ii) Objective Approach: Under objective approach, a man’s faculty to pay may be measured according to:

(a) (a) Consumption: Consumption, as a criterion of ability to pay, is not a sound criterion, because consumption or utilisation of the services of the State by the poor is considered to be out of all proportion to their means, and, as such, it cannot be taken as a practical principle of taxation.

(b) (b) Property: Property also cannot be a fair basis of taxation, for properties of the same size and description may not yield the same amount of income; and some persons having no property to show may have large incomes, whereas men of large property may be getting small incomes. Thus, to tax according to property will not be taxation according to ability.

(c) (c) Income: Income, however, remains the single best test of a man’s ability to pay. But even in the case of income, the tax will be in proportion to faculty. The principle of progression is satisfied under this criterion.

Proportional vs. Progressive Taxation

Proportional Taxation:

Case for:

1. 1. Equitable rate for taxation, i.e., equal contribution

2. 2. Simpler taxation system

3. 3. Tax is charged in proportion to the tax payers’ income

4. 4. It encourages saving and drives in capital

5. 5. Investment is encouraged and in the long run increases the level of income and employment

6. 6. The tax-payer has the motivation to pay tax as it is simple and has less burden on high-income earners

Case against:

1. 1. The burden of tax under proportional tax system is heavily fall on low-income earners, i.e., it is regressive

2. 2. It does not entail equal sacrifice. All the tax payers have to pay tax at the same rate or equal proportion. The sacrifice should be in proportion to the tax payers’ capacity

3. 3. The government cannot raise substantial tax revenue which is used for public welfare

4. 4. Increased use of luxuries

5. 5. Less productive

6. 6. Economic instability as a result of weakening purchasing power of the people

7. 7. Economic inequalities cannot be reduced

Progressive Taxation:

Case for:

1. 1. As income increases, the utility of each addition to the income decreases. Hence, the payment of the tax by the rich entails much less sacrifice than by the poor. The rich people should be, therefore, taxed at higher rates

2. 2. By taxing affluent class more, its expenditure on luxurious goods is curtailed.

3. 3. Progressive taxation yields much greater revenue and hence it is more productive.

4. 4. Progressive taxation is more economical and equitable. The cost of collection of the taxes does not increase when the rate of tax increases. It calls forth a proportional sacrifice from the tax payers. It places the heaviest burden on the broader shoulders.

5. 5. The principle of progression gives to the tax system much-needed elasticity or flexibility. When there is an emergency, only a little raising of the rates may be sufficient to meet the situation.

6. 6. Progressive taxation promotes economic stability and checks cyclical fluctuations. The government can easily control the inflationary and deflationary pressures by checking the purchasing power of the people through progressive taxation.

7. 7. Progressive taxes are badly needed for reducing economic inequalities and for bring about more equitable distribution of wealth in the community.

8. 8. Progressive taxes may increase the desire to work, save and invest.

Case against:

1. 1. The degree of progression is settled by the finance minister on no definite and scientific basis. It is purely his personal opinion.

2. 2. It is pointed out that the principle of progression cannot be advocated on the ground of promoting welfare, because welfare is subjective and cannot be measured.

3. 3. Heavy progressive taxation will discourage saving, drive out capital and thus hamper trade and industry.

4. 4. Risky investments which yield high returns are discouraged because the proportion of tax increases as income increases. Reduction of investment will reduce the level of income and employment in the country.

5. 5. Progressive taxes put premium on idleness and leisure since they penalise those who work hard and make more money. It amounts almost the graduated confiscation of rich man’s income.

6. 6. Progressive taxes are more vulnerable to tax-evasion. But the possibility of evasion in proportional taxation is not less. It all depends on the social conscience.

Taxable Capacity

The taxable capacity can be used in two senses:

(a) (a) In the absolute sense, and

(b) (b) In the relative sense.

(a) Absolute Taxable Capacity: It means how much a particular community can pay in the form of taxes without producing unpleasant effects. There are two extreme views about absolute taxable capacity:

(i) (i) The capacity to pay without suffering, and

(ii) (ii) The capacity to pay regardless of suffering

Sir Josiah Stamp defines taxable capacity as the margin of total production over total consumption or the amount required to maintain the population at subsistence level. It is the maximum amount of taxation that can be raised and spent to produce the maximum economic welfare in that community.

(b) Relative Taxable Capacity: On the other hand, relative taxable capacity means the respective contribution which the communities should make towards a common expenditure, for example, provincial contribution to control expenditure. Dalton says the absolute capacity is a myth and relative taxable capacity is a truth. A relative limit may be reached without reaching the absolute limit.

Factors Governing Taxable Capacity: Following are the factors governing taxable capacity:

(a) (a) Number of inhabitants: It is quite obvious that the larger the population the greater is the taxable capacity of the community to contribute towards the expenses of the government.

(b) (b) Distribution of wealth: If wealth is more equally distributed, the taxable capacity will be correspondingly reduced. But if there are large accumulations of wealth in a few hands, the government can raise more money by taxing the rich.

(c) (c) Method of taxation: A scientifically constructed tax system with a wise admixture of the various types of taxes, direct and indirect, is sure to bring a larger yield.

(d) (d) Purpose of taxation: If the purpose of taxation is to promote welfare of the people, they will be more willing to tax themselves. But if the bulk of the public funds is to be spent on the maintenance of foreign armed forces and for the upkeep of a costly civil service, in which foreign element is predominant, as was the case in Pakistan, the taxable capacity must correspondingly shrink.

(e) (e) Psychology of tax-payers: The taxable capacity much depends on the people’s attitude towards a government. A popular government can galvanise the spirit of the people and prepare them for greater sacrifice. Psychology of the people is an important factor, and unless they are properly approached, they may be unwilling to tax themselves.

(f) (f) Stability of income: If the income of the citizens is precarious, there will be not much scope for further taxation.

(g) (g) Inflation: High inflation rate lowers the purchasing power of people and it cripples many; it has an adverse effect on taxable capacity.

(h) (h) Level of economic development: The level of economic development attained by a country is an important determinant of its taxable capacity. Undoubtedly, all highly developed countries of the world have greater taxable capacity than the under-developed countries.

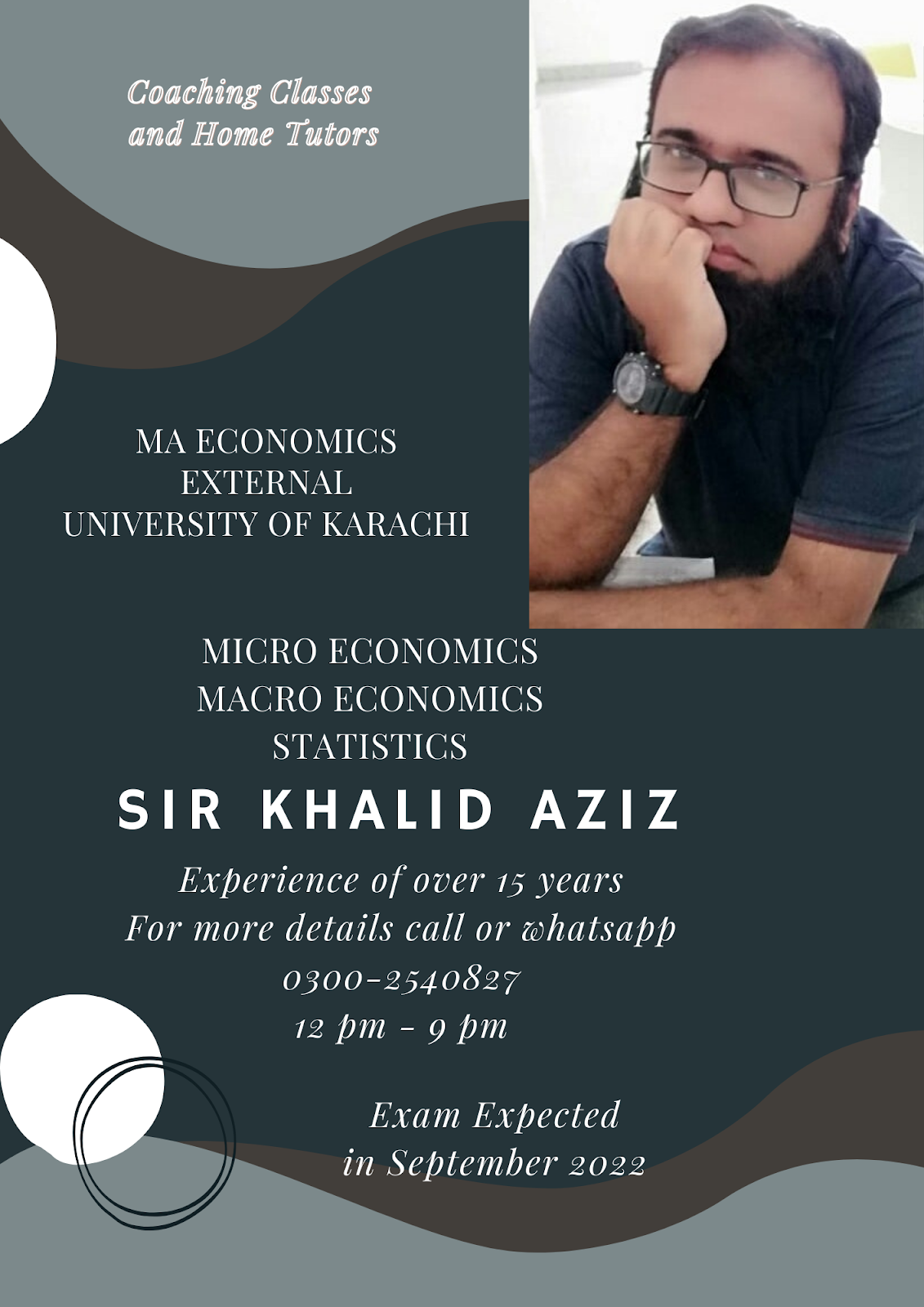

MA ECONOMICS

NOTES AVAILABLE IN REASONABLE PRICE

Macroeconomics and Microeconomics: Chit Chat

CHIT-CHAT TIME Commerce Heaven (In this conversation after getting 1000 Rupees Khalid is going with his friend Tariq to purcha...

Subscribe to:

Post Comments (Atom)

-

CHIT-CHAT TIME Commerce Heaven (In this conversation after getting 1000 Rupees Khalid is going with his friend Tariq to purcha...

-

Definition and Explanation: Classic economics covers a century and a half of economic teaching. Adam Smith wrote a classic book entitled, ...

-

Offer Curve Diagram Tariff A B A&B Expansion A B A&B Variants: Inelastic Demand by ... Country A...

Total Pageviews

CLASSES

Guess Papers

No comments:

Post a Comment