WHY PRIVATIZATION IS NECESSARY FOR ECONOMIC GROWTH IN

PAKISTAN?

The decade of 1970s in Pakistan witnessed a massive redistribution of national

assets from the private owners to the state. The reason underlying the then Government’s

thinking for this extremely radical action was that the national wealth was being

concentrated in the hands of few families and the rich were getting richer and the poor

getting poorer. It was asserted by the proponents of this strategy that the state control

over allocation of the resources would promote the best interests of the poor. The

intellectual support for this strategy was drawn from the success of the Soviet Union and

the socialist economic model practised in that part of the world.

Two decades later it turned out that these assertions and assumptions that drove

this particular line of action i.e. nationalization was not only unrealistic and flawed but

the consequences were exactly opposite to what the intentions were. The collapse of the

Soviet Union and the bankruptcy of the socialist model eroded the ideological

underpinning of this strategy and the actual results on the ground in Pakistan and almost

all the developing countries shattered the ideal and utopian dreams of the proponents of

this philosophy. Pakistan’s public enterprises including banks became a drain on the

country’s finances through continuous hemorrhaging and leakages and a drag on the

economic growth impulses. The poor instead of benefiting from the state’s control over

these assets were actually worse off as almost Rs. 100 billion a year were spent out of the

budget annually on plugging the losses of these corporations, banks and other enterprises.

These public enterprises became the conduit for employing thousands of supporters of

political parties that assumed power in the country in rapid succession and a source of

patronage, perks and privileges for the ministers and the favoured bureaucrats appointed

to manage these enterprises. These employees and managers had neither the managerial

expertise nor technical competence to carry out the job. Instead of providing goods &

services to the common citizens at competitive prices efficiently, the public enterprises

turned into avenues for loot and plunder, inefficient provision of services and production

of shoddy goods. It was a common knowledge that getting a telephone connection in

Pakistan required years not months and that too with the help of sifarish and exchange of

bribes. No wonder the country was able to install less than 3 million telephones in the

entire 50 years of its history while under a deregulated and private sector driven

environment an additional 6 to 7 million mobile phone connections were given to

Pakistanis from all walks of life without any favour or discrimination in one year alone

i.e. 2004.

The hangover of the past in general and the lingering fascination for the socialist

model among some of our intellectuals in particular continue to have a dominant

influence on our thinking. Some of the resentment against private profit making is also

quite legitimate and understandable. In the past, private entrepreneurs in Pakistan did not

make ‘profits’ in the real economic sense of the word by earning a return on their

investment in a competitive world. On the contrary, they earned ‘rents’ through the maze

of permits, licences, preferred credit by the banks, subsidies, privileges, concessions and

specific SROs granted to the favoured few. Naturally when one sees people becoming

rich not through the dint of their hard work and enterprise but by manipulation, back door

entry, connections, reciprocity, paying bribes, adopting extra legal means, bypassing the

established rules and laws, getting scarce foreign exchange quotas, evading taxes,

defaulting on bank loans and rigging the markets etc., we should not be surprised to see

the venom against the so called ‘private profits’.

The policy reforms introduced in Pakistan by the Nawaz Sharif Government in

1991 and more importantly followed by that strong citadel of socialist raj – India – were a

watershed reflecting the new realities of economic life. These reforms, though quite

extensive and diverse, could be summed up for the sake of simplification in three words –

Liberalization, Deregulation and Privatization. The results of Indian reforms are quite

evident before us. During the first 45 years of its independence until 1991, India was

hardly able to achieve per capita income growth of 1 percent per year and the incidence

of poverty remained persistently high. In the 12-year period since 1991, India’s average

per capita income growth has been 4 percent per year, poverty has been declining ever

3

since and has fallen below 25 percent. Pakistan, unfortunately, could not follow through

these reforms in a continuous and consistent manner despite the fact that both Benazir

and Nawaz Sharif governments were fully committed to these reforms. For example, 12

percent shares of PTCL were first sold to the general public in 1993-94 and it has been on

the privatization agenda of every successive government since then. The short term

political expediency may dictate a different behaviour at present, but I am quite sanguine

that the PPP and PML(N) would have pursued the same path were they at the helm of the

affairs. Thus, there is a broad political consensus in the country that privatization is in

the larger national interest of the country.

Privatization has to be seen in the overall context of the respective roles of the

state and markets. The State has to be strong to combat the excesses of the market and

cope with market failures. It is not that the state should play a lesser or reduced role but a

different role in so far as it provides an enabling environment for equitable development

and creates necessary conditions for growth through investment in human development

and infrastructure. The government’s effective role in regulating and monitoring the

market has to be strengthened to promote healthy competition and avoid the rigging of

the market by a few. Markets are the best known vehicle for efficient allocation and

utilization of resources and thus the decisions as what goods and services to produce,

how much to produce, distribute and trade can be done well only by the private sector

and not by the bureaucrats. This division and redefinition is also essential to reduce

corruption and generate sustained and equitable growth in the country. Market-based

competition, privatization of public banks and a strong regulator have successfully

reformed the banking sector in Pakistan during the last several years and this model

should be replicated elsewhere in the economy. It is not ideology but pragmatism and

learning from the past mistakes that should drive our economic policies and strategies.

Growth takes place only when productivity from the existing resources keeps on rising.

The global experience shows that by and large, productivity actually declines or remains

stagnant when the businesses are managed and operated by the government thus slowing

down or hurting the pace of growth.

4

I will now turn to the economic rationale of privatization that is not fully

understood by many. In particular, there is a popular view that it is okay to sell the loss

making enterprises but retain the profit making entities such as PTCL and PSO in the

public sector. It is true that the budgetary stress and commercial bank borrowing factors

are not valid in such cases but there is a larger economic case for the divestiture of even

such profit making enterprises. The main logic behind this divestiture is that it will

promote efficient allocation of scarce resources, optimal utilization of resources, making

sound, timely and market responsive investment choices, winning and retaining

customer’s loyalty through better service standards and lower product prices or user

charges and contributing to the expansion of the economy through taxes, dividends etc. I

would take the most debated example – that of the PTCL – as an illustration of the

general point I am making about the economic rationale for privatizing profit making

public sector enterprises.

The most oft pronounced arguments against privatization of profit making

enterprises are (a) why fix it when it ain’t broke? (b) Protection of workers (c) a better

and more professional management can bring about the same results as under

privatization. The basic reason for privatizing these enterprises is that the government

should not be in the business of running businesses but regulating businesses. The role of

the government should be that of a neutral umpire, who lays down the ground rules for

businesses to operate and compete, to monitor and enforce these rules, to penalize those

found guilty of contraventions and to adjudicate disputes between the competing business

firms. If the government owned firm itself is one of the players in the market, there is a

strong conflict of interest and the other market players lose confidence in the neutrality of

the umpire. Under these circumstances, the market becomes chaotic, disorderly and

unruly as there is no neutral ‘person’ to monitor and enforce the rules. The economy thus

pays a heavy price for this loss of the market mechanism in the production, sale and

distribution of goods and services. The present controversy between the PIA and private

airlines is a manifestation of this tendency. If the ‘umpire’ favours its owned enterprise

i.e. PIA and discriminates against the rival private airlines, the ultimate result would be

the winding up of these airlines. The growth of aviation industry would suffer as the

present competition is cutting down the prices and stimulating demand for air travel in

5

the country. In absence of such competition, the PIA would have the sole monopoly and

the planes would fly with empty seats as the ticket prices would not be market based but

arbitrarily high. The consumers of airline industry – existing and potential – will be the

loser in this bargain.

The same argument can be applied in case of PTCL. If the Government had

continued to own and manage PTCL, the private sector competing firms would have felt

that they would always remain at a disadvantage in relation to the PTCL. The constant

fear that the government’s coercive powers and full force of policy making ability would

always be used to safeguard and enhance the interests of PTCL. This would have kept

the private firms away from investment in the fixed telephone or wireless loop segments.

If this may not be true under one particular set of rulers, the apprehension that such an

eventuality may happen at some time in the future keeps prospective investors away from

that field of business. The growth of a dynamic private sector in the economy is thus

stifled. The PTCL would under that scenario preserve its monopoly, pass on its

inefficiencies to the customers, charge exorbitant prices and resort to seeking concessions

of various kinds from the government. The result would be stagnation in the growth of

fixed telephony in the country and poor service to the customer. So while the PTCL is

not broke and is indeed profitable it needs to be privatized to provide a level playing field

for fostering competition, stimulating demand, expanding telecom customer base,

improving service delivery and contribute to rapid economic growth. None of this will

happen if the PTCL remains a public owned and managed firm.

A lot is being made of the fact that the PTCL was making huge profits for the

exchequer and these profits will now be diverted to the private owner. The facts are quite

contrary to this assertion. The Government of Pakistan will still retain 62 percent of the

shares while the private operator will have only 26 percent. Thus out of each billion

rupees of profits earned by PTCL, the GoP will receive Rs. 620 million while the private

operator only Rs. 260 million. In addition, the PTCL will continue to pay the corporate

tax on its income. The burning desire to transfer the management to a private investor

was that the profits earned by the PTCL were largely derived not from its own efficient

operations but from its monopoly status as the sole provider of fixed telephony in the

6

country. In the coming years, the PTCL will have to compete for its market share as it

has lost its monopoly and it was quite likely that the public sector ownership will act as a

serious constraint and the level of profits will be eroded over time.

Since the private sector competitors of PTCL will have more flexibility, agility

and capacity to respond and seize the opportunities for expansion and improved customer

service, they will give a hard time to rule bound, inflexible and slow moving public

sector owned PTCL. However, competent and able top managers and the Board of

Directors may be, they have to follow set procedures, prior clearances and approvals by

multiple ministerial bodies before they can make any operational decisions of

significance. U-Fone lost 18 months’ valuable time facing various inquiries into its

procurement while its competitors were enhancing their market share at its cost. Such a

scenario is likely to recur once a government owned PTCL is pitted against several

private competitors.

The fears about employment losses in the industry as a result of privatization are

also, by and large, unfounded. The example of the banking industry privatization

controverts those who claim that privatization means jobs are lost. In 1997 when the

restructuring, down-sizing and privatization of the nationalized commercial banks picked

up speed there were 105,000 employees working in the financial sector. After

privatization was completed, the banking industry has expanded and the work force has

expanded to 114,000. It is true that the pattern of employment has changed and more

productive and skilled workers have been taken in at the expense of low skilled or

unskilled. There is no doubt that the PTCL will also expand under its new owners and

employ more people but in the skilled category. This upgradation of skills will raise

productivity of the firm as well as of the industry.

The skill mix of the staff employed by the PTCL and its numbers at present are

inappropriate to meet the new challenges of providing high standards of value added

services and new product development. One of the difficulties faced by the public sector

businesses is that they cannot pay market based remunerations to their executives or

highly technical manpower. If the PTCL is not allowed to pay more than MP1 scale to its

7

Chief Executive i.e. Rs. 200,000 per month which is a fraction of what senior executives

in the rival private firms get, should we expect the PTCL to attract, retain or motivate

high performing manpower. The field gets tilted against a public sector company as it

has skill gaps and redundancies and is unable to provide value added services of the same

quality as provided by the private sector rivals.

The process of hiring and firing of employees in a public sector company such a

PTCL is highly convoluted, complex and cumbersome. Those found guilty of infractions

or negligence of duties or even corruption can only be dispensed with after a protracted

process of disciplinary proceedings that sometimes take several years to complete. In the

meanwhile, the employee continues to stay put in service and receives all the emoluments

and perks. In a rare case, a departmental inquiry comes up with a guilty verdict, the

employee can appeal to the Federal Services Tribunal and if he is unsuccessful, then all

the way to the Supreme Court. Why will any right minded boss choose to go through

such an ordeal?

The alarm of employment losses after privatization is also unjustified for another

reason. Telecom sector has already generated, after deregulation, hundreds of thousands

of new jobs through public call offices, calling cards and pre-paid card companies,

Internet Service Providers, mobile phone companies, broad band services, and other

value added services under the private sector. As the penetration ratios in Pakistan are

still quite low, there is going to be a large expansion in the telecom sector.

The losses of redundant jobs in PTCL, if any, will be more than offset by new

productive jobs in the Local Loop, Wireless Loop and LDI companies being set up in the

private sector. Industry estimates that 100,000 new jobs will be added during next 3 – 5

years. The substitution of unskilled jobs in the PTCL by the skilled jobs in the telecom

industry as a whole will raise the productivity of the sector as well as that of the user

companies and institutions. Those among the unskilled who can be retrained or

redeployed could be retained minimizing the overall loss of jobs within the PTCL itself.

If the PTCL itself is able to expand its services and operations, the manpower that is

surplus to its present requirements can be productively employed. Thus the fears of

8

workers losing protection under a privatized entity appear to be misplaced. After all, the

PTCL is the only telecom company that has been in the business for the last 58 years.

The oversight, monitoring and guidance capabilities of public enterprises are

ridden with the aggravated problems of principal – agent relationship. As the Board

Members, however able and honest they may be, have no direct personal stakes in the

well-functioning of a public enterprise, they cannot be expected to devote as much time

or energy to the Board’s affairs as the private strategic investors would. Thus, the

PTCL’s governance structure would always remain second best to its private sector

competitors and put it at a comparative disadvantage. If a more callous Minister is

unfortunately appointed to chair the Board, the appointments, award of contracts and

transfers and postings will do further damage to the performance of the PTCL.

The temptation by the elected political leaders or other rulers to interfere in the

affairs of the public sector companies is not only high but natural. They are constantly

accosted by their constituents for jobs, contracts, postings and transfers and it is not

possible for them to keep on saying no to everyone all the time. In some cases, they have

to yield to pressures. It is, therefore, necessary to sever the connection between the

government and the business.

How can a public sector company then be expected to show same results as its

private sector competitors whose compensation structure is driven by performance,

whose managers enjoy full powers of hiring and firing without any restraint, their Boards

have direct stakes in ensuring good governance and the political interference is almost

non existent?

The legacy of PTCL inherited from the culture of the Post and Telegraph

Department cannot therefore be washed away if it operates under these constraints. This

culture can only be replaced by a dynamic competition-oriented culture under the

leadership of a private sector operator.

9

As a government entity, PTCL is considered a rich cash cow to meet the fiscal

needs rather than a business enterprise that requires funds for its own maintenance and

operations and more important for its investment needs. The compulsions of extracting

as much profits and cash for meeting fiscal deficit will always predominate and the

imperatives of expanding the network, infrastructure and services through retained

earnings will be neglected. Even assuming that a perceptive government does allow

PTCL the funds to make investment, it is not obvious if these will be used in an efficient

and cost-effective manner. The World Bank has recently blacklisted 200 firms for

padding contracts and bribing officials in public sector procurement awards in a number

of developing countries.

It must once again be stressed that private sector ownership and efficient

functioning of market mechanism require certain legal and regulatory institutions. In

absence of these institutions, private monopolies or oligopolies can surface, market

distortions can accentuate and markets can be rigged for the benefit of few. Strong legal

and regulatory institutions would be able to counter these evils forcefully and provide a

level playing field for all market participants. We have to strengthen these legal and

regulatory institutions in the country.

Public policy should also be geared at removing preferential treatment or granting

of concessions or privileges to a particular segment of the population. During the last

five years, the Government has endeavoured to move in this direction and act in an even

handed manner. No firm specific SROs have been issued to favour a particular enterprise

at the expense of others. Under these circumstances, private sector will earn true ‘profits’

through competition and not ‘rents’ and the justified grudge against the private sector will

be minimized.

CONCLUSION:

Privatization contributes to economic growth through productivity gains,

efficient utilization of resources, better governance and expansion in output and

employment. Profit making enterprises under the public sector may be making profits

10

due to the unique market structure such as monopoly or other privileges or concessions

conferred upon them by the government but it does so at the expense of the consumer

who has to pay higher than market price for the product or the services. The ordinary

consumer gets a benefit only through competition among private sector firms in form of

lower prices and better services as has been demonstrated in the cases of banking,

telecommunications and, more recently, air travel.

In a deregulated market environment, public ownership becomes a serious

constraint as the rule – bound procedures and the rigidity in the structure do not allow

public sector companies the flexibility to respond promptly to dynamic market

conditions. Furthermore, the government’s role as a regulator and neutral umpire

becomes questionable once it is itself a participant in the game through its own company.

This stifles competition and subverts expansion and growth by the private sector

companies.

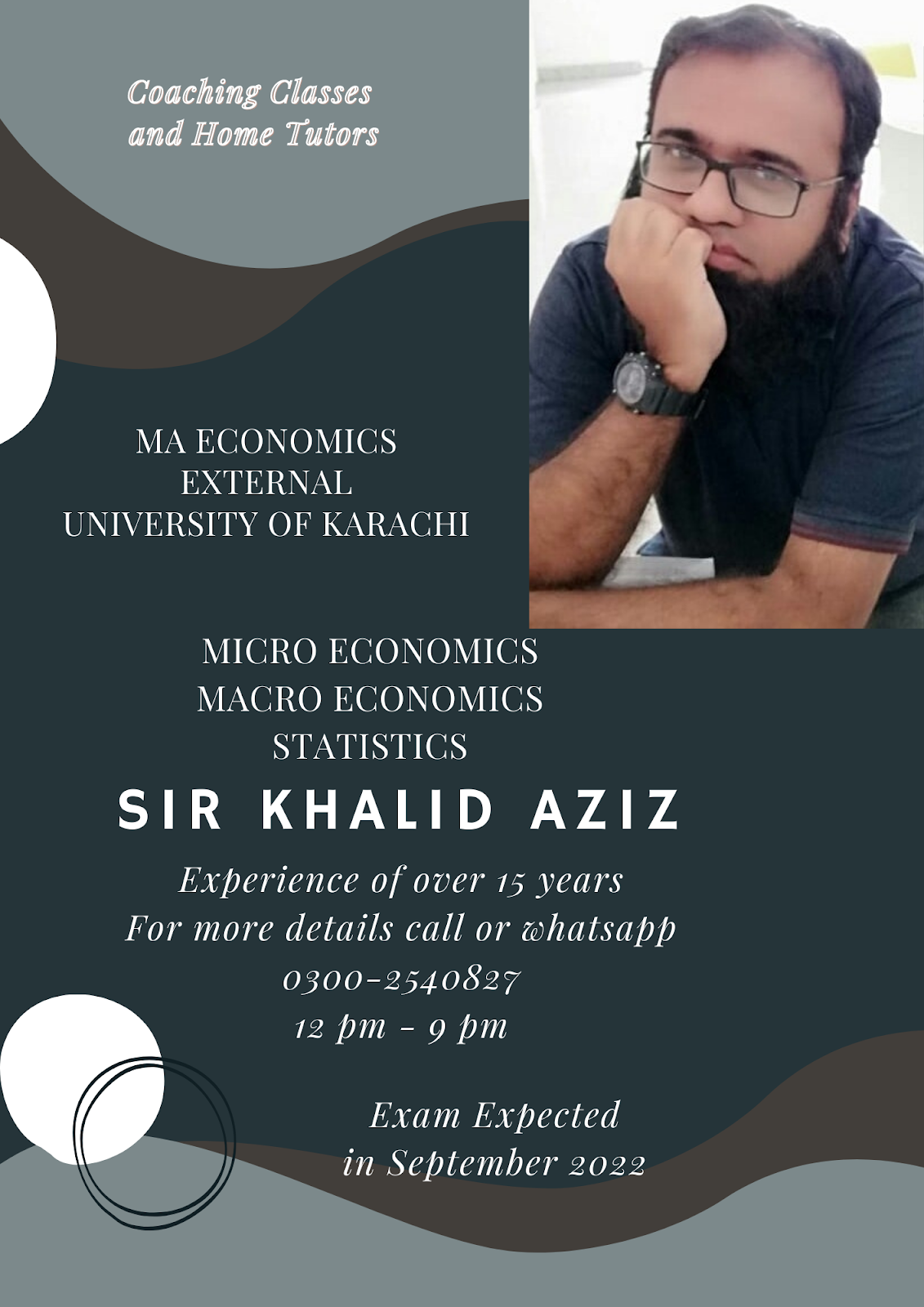

MA ECONOMICS

NOTES AVAILABLE IN REASONABLE PRICE

Macroeconomics and Microeconomics: Chit Chat

CHIT-CHAT TIME Commerce Heaven (In this conversation after getting 1000 Rupees Khalid is going with his friend Tariq to purcha...

Subscribe to:

Post Comments (Atom)

-

CHIT-CHAT TIME Commerce Heaven (In this conversation after getting 1000 Rupees Khalid is going with his friend Tariq to purcha...

-

Definition and Explanation: Classic economics covers a century and a half of economic teaching. Adam Smith wrote a classic book entitled, ...

-

Offer Curve Diagram Tariff A B A&B Expansion A B A&B Variants: Inelastic Demand by ... Country A...

Total Pageviews

CLASSES

Guess Papers

I strongly disagree that privatization is necessary for economic growth in Pakistan.

ReplyDeleteI have audited/reviewed 12-13 privatization transactions of GOP and im well aware of all the flaws/issues in the process.

Moreover, WHAT IS PURPOSE OF PRIVATIZATION AS PER PRIVATIZATION ? IT IS TO REDUCE DEBT AND POVERTY (90:10 RATIO). THIS MAIN PURPOSE IS NOT BEING ACHIEVED.

Regarding selling old/loss making entities ...... why are investors buying loss making entities ??? Answer: Govt pays most of loans of those entities, this reducing financial costs, and the investor is sure that he make good profits out of the existing operations and expanding the company further. I can name many privatized units which were loss making but were giants of GOP and now the investors are enjoying their profts and Govt has given subsidies to those companies as well. Why doesnt Govt invests in those companies and brings good management, instead of selling to private investors? Its a big game and a big drama and another way to make money !!!!!

GOVT has lost its precious national assets in this process without achieving the purpose and DEBT BURDEN AND POVERTY HAS INCREASED.