Generally speaking, Open Market Operation (OMO) is a transaction on the open financial market, involving fiscal instruments such as governments` securities, or commercial papers, commenced by a central banking authority, with the purpose of regulating the money supply and credit conditions. In terms of their duration, there may be distinguished two types of OMO – PEMO (permanent OMO) and REPO (temporary OMO, or repurchase agreement OMO). Most central banks focus their monetary-regulating policies and monitoring on REPO transactions. As transactions, both REPO and PEMO serve to drain or add the available to the banking system reserves. However, PEMO means an outright buying or selling of government securities, while a distinguished feature of REPO is that they are generally short-term, often overnight, and the securities are subject to buy-back.

OMO, as related to the commercial banks, serves a liquidity-providing function. The central banking authority may provide money reserve to the commercial banks by buying securities and unleashing money in the banking system, or it may sell securities. By selling, the central bank (or a group of reserve banks as is the case with the US FED) may lower the interest. The institution does so by means of lowering the interest rates on the government securities and by increasing their offering and, consequently, price, on the open market. Often, OMO is a direct instrument of monetary policy, because the instrument influences the money supply directly. Forex swaps and other types of foreign exchange operations are also open market operations.

For the European Union, the European Central Bank (ECB) is an independent monetary institution, which is responsible for the monetary policy of the Union and the Euro zone. OMOs of the ECB, as part of the European System of Central Banks, are governed and regulated by CHAPTER IV. Article 18 of the Statute of the European System of Central Banks and of the European Central Bank declares that while attaining the aims of the ESCB and implementing its tasks, the ECB, together with the central banking institutions may: — function in the financial markets through the purchase and sale outright or via repurchase agreements, conducted in different currencies and precious metals. In the functioning of the ECB and the national banks in Europe, OMO serves not only as the aforementioned liquidity generator and a steering wheel for short-term interest rates, but also as a way to proclaim the ECB position on the monetary situation in the Euro area. Between mid - 2009 and mid - 2010 the central banks from the Eurosystem plan to conduct OMO purchases in covered bonds with a targeted nominal of EUR60.000.000.000.

According to Reuters, it is the open market operations that helped the Fed to hold interest rates down by backing the WWII borrowing extravaganza of the US government, while refinancing effectively the debt at low cost. Reuters also adds that the Fed of Bernanke is acting in a similar manner through its Treasury bills purchase program.

FED’s Federal Open Market Committee (FOMC) is responsible for conducting OMO policy in the US. FOMC has 12 members. Seven of the members come from the Board of Governors of the Federal Reserve System and thus constitute a majority. They are appointed by the President of the US and approved by the Senate before starting their 14 years of service in the Board. The other 5 representatives in the Committee are Presidents of the Reserve Bank: one of them is the President of the district FRB of New York. This district reserve bank is the largest and most prominent of the twelve reserve banks.

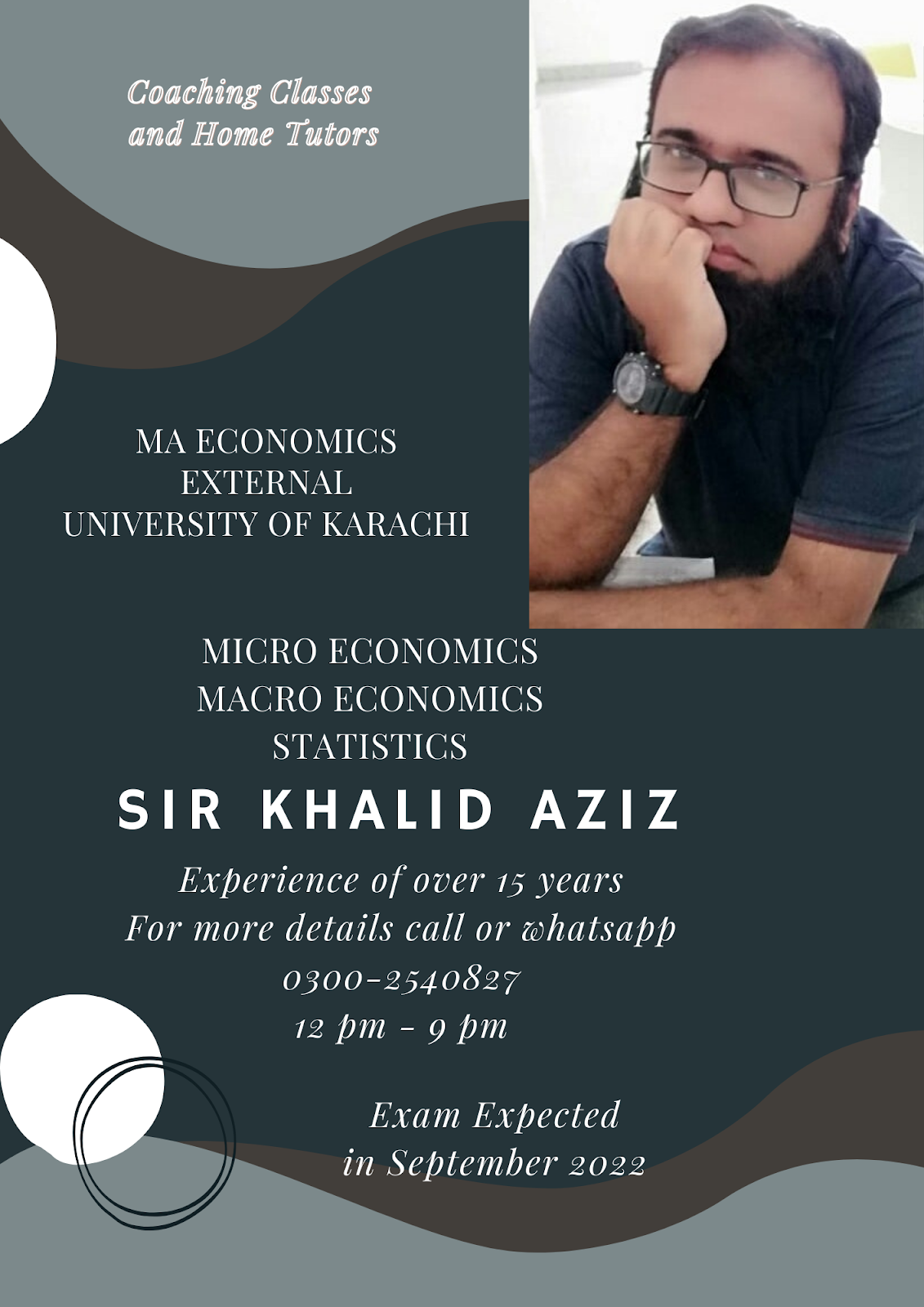

MA ECONOMICS

NOTES AVAILABLE IN REASONABLE PRICE

Macroeconomics and Microeconomics: Chit Chat

CHIT-CHAT TIME Commerce Heaven (In this conversation after getting 1000 Rupees Khalid is going with his friend Tariq to purcha...

Subscribe to:

Post Comments (Atom)

-

CHIT-CHAT TIME Commerce Heaven (In this conversation after getting 1000 Rupees Khalid is going with his friend Tariq to purcha...

-

Definition and Explanation: Classic economics covers a century and a half of economic teaching. Adam Smith wrote a classic book entitled, ...

-

Offer Curve Diagram Tariff A B A&B Expansion A B A&B Variants: Inelastic Demand by ... Country A...

Total Pageviews

CLASSES

Guess Papers

No comments:

Post a Comment