Theories of Taxation:

The economists have put forward many theories or principles of taxation at different times to guide the state as to how justice or equity in taxation can be achieved. The main theories or principles in brief, are:

(i) Benefit Theory:

According to this theory, the state should levy taxes on individuals according to the benefit conferred on them. The more benefits a person derives from the activities of the state, the more he should pay to the government. This principle has been subjected to severe criticism on the following grounds:

Firstly, If the state maintains a certain connection between the benefits conferred and the benefits derived. It will be against the basic principle of the tax. A tax, as we know, is compulsory contribution made to the public authorities to meet the expenses of the government and the provisions of general benefit. There is no direct quid pro quo in the case of a tax.

Secondly, most of the expenditure incurred by the slate is for the general benefit of its citizens, It is not possible to estimate the benefit enjoyed by a particular individual every year.

Thirdly, if we apply this principle in practice, then the poor will have to pay the heaviest taxes, because they benefit more from the services of the state. If we get more from the poor by way of taxes, it is against the principle of justice?

(ii) The Cost of Service Theory:

Some economists were of the opinion that if the state charges actual cost of the service rendered from the people, it will satisfy the idea of equity or justice in taxation. The cost of service principle can no doubt be applied to some extent in those cases where the services are rendered out of prices and are a bit easy to determine, e.g., postal, railway services, supply of electricity, etc., etc. But most of the expenditure incurred by the state cannot be fixed for each individual because it cannot be exactly determined. For instance, how can we measure the cost of service of the police, armed forces, judiciary, etc., to different individuals? Dalton has also rejected this theory on the ground that there s no quid pro qua in a tax.

(iii) Ability to Pay Theory:

The most popular and commonly accepted principle of equity or justice in taxation is that citizens of a country should pay taxes to the government in accordance with their ability to pay. It appears very reasonable and just that taxes should be levied on the basis of the taxable capacity of an individual. For instance, if the taxable capacity of a person A is greater than the person B, the former should be asked to pay more taxes than the latter.

It seems that if the taxes are levied on this principle as stated above, then justice can be achieved. But our difficulties do not end here. The fact is that when we put this theory in practice, our difficulties actually begin. The trouble arises with the definition of ability to pay. The economists are not unanimous as to what should be the exact measure of a person's ability or faculty to pay. The main view points advanced in this connection are as follows:

(a) Ownership of Property: Some economists are of the opinion that ownership of the property is a very good basis of measuring one's ability to pay. This idea is out rightly rejected on the ground that if a persons earns a large income but does not spend on buying any property, he will then escape taxation. On the other hand, another person earning income buys property, he will be subjected to taxation. Is this not absurd and unjustifiable that a person, earning large income is exempted from taxes and another person with small income is taxed?

(b) Tax on the Basis of Expenditure: It is also asserted by some economists that the ability or faculty to pay tax should be judged by the expenditure which a person incurs. The greater the expenditure, the higher should be the tax and vice versa. The viewpoint is unsound and unfair in every respect. A person having a large family to support has to spend more than a person having a small family. If we make expenditure. as the test of one's ability to pay, the former person who is already burdened with many dependents will have to' pay more taxes than the latter who has a small family. So this is unjustifiable.

(c) Income as the Basics: Most of the economists are of the opinion that income should be the basis of measuring a man's ability to pay. It appears very just and fair that if the income of a person is greater than that of another, the former should be asked to pay more towards the support of the government than the latter. That is why in the modern tax system of the countries of the world, income has been accepted as the best test for measuring the ability to pay of a person.

Proportionate Principle:

In order to satisfy the idea of justice in taxation, J. S. Mill and some other classical economists have suggested the principle of proportionate in taxation. These economists were of the opinion that if taxes are levied in proportion to the incomes of the individuals, it will extract equal sacrifice. The modern economists, however, differ with this view. They assert that when income increases, the marginal utility of income decreases. The equality of sacrifice can only be achieved if the persons with high incomes are taxed at higher rates and those with low income at lower rates. They favour progressive system of taxation, in all modern tax systems.

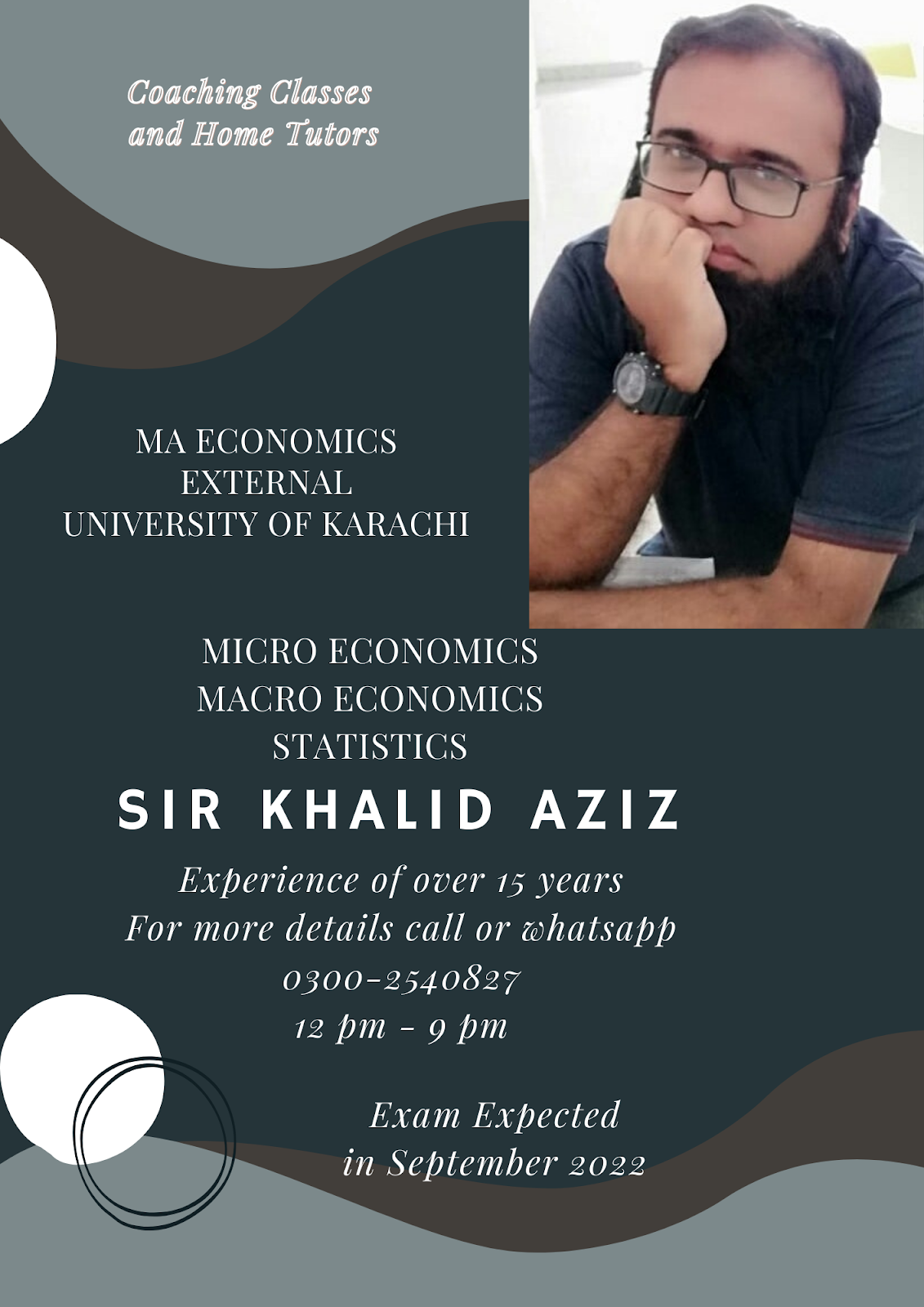

MA ECONOMICS

NOTES AVAILABLE IN REASONABLE PRICE

Macroeconomics and Microeconomics: Chit Chat

CHIT-CHAT TIME Commerce Heaven (In this conversation after getting 1000 Rupees Khalid is going with his friend Tariq to purcha...

Subscribe to:

Post Comments (Atom)

-

CHIT-CHAT TIME Commerce Heaven (In this conversation after getting 1000 Rupees Khalid is going with his friend Tariq to purcha...

-

Definition and Explanation: Classic economics covers a century and a half of economic teaching. Adam Smith wrote a classic book entitled, ...

-

Offer Curve Diagram Tariff A B A&B Expansion A B A&B Variants: Inelastic Demand by ... Country A...

Total Pageviews

CLASSES

Guess Papers

No comments:

Post a Comment